India ICE vs EV sales | For top 2W, 3W, 4W OEMs in July 2025

In July 2025, the overall penetration of EVs in the 2W market was 7.6%. For passenger 3W L5 autos, it was 37.2%, and for cargo 3W L5 autos, it was 21.2% and for 4W, it was 4.8%. This article aims to showcase where EV sales stand compared to the overall vehicle sales in the 2W, 3W, and 4W categories.

Also Read: Overall EV sales in July 2025

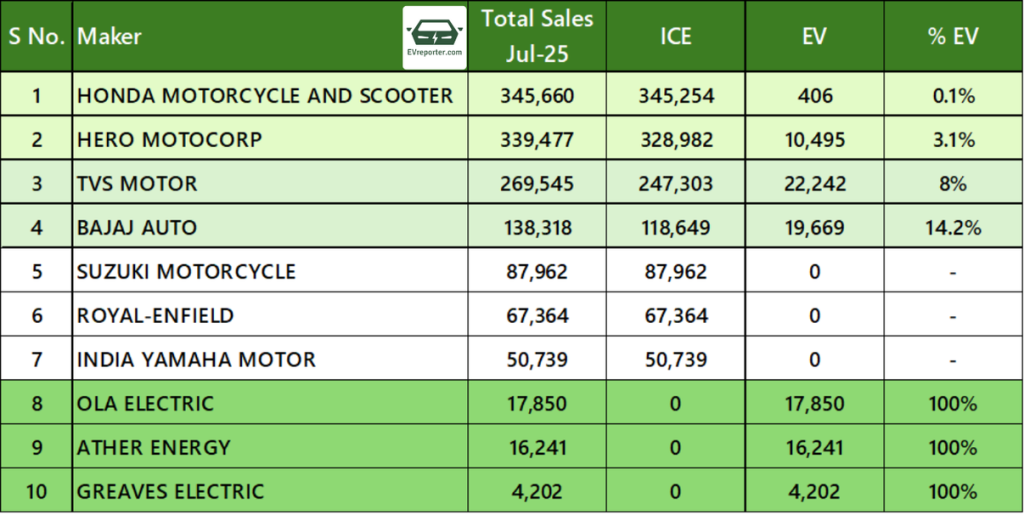

OEM wise Leading 2W Sales for ICE and EV, Jul 2025

Source: Vahan Dashboard as of Aug 2, 2025. Telangana Data not included.

In July 2025, the two-wheeler market recorded a mix of ICE and EV sales, with Honda Motorcycle and Scooter leading overall sales (3,45,660 units) but only 0.1% from EVs. Bajaj Auto (14.2%), TVS Motor (8%), and Hero MotoCorp (3.1%) reported notable EV adoption, while Suzuki, Royal Enfield, and Yamaha remained fully ICE-dependent. Pure EV players Ola (17,850), Ather (16,241), and Greaves (4,202) had 100% EV sales.

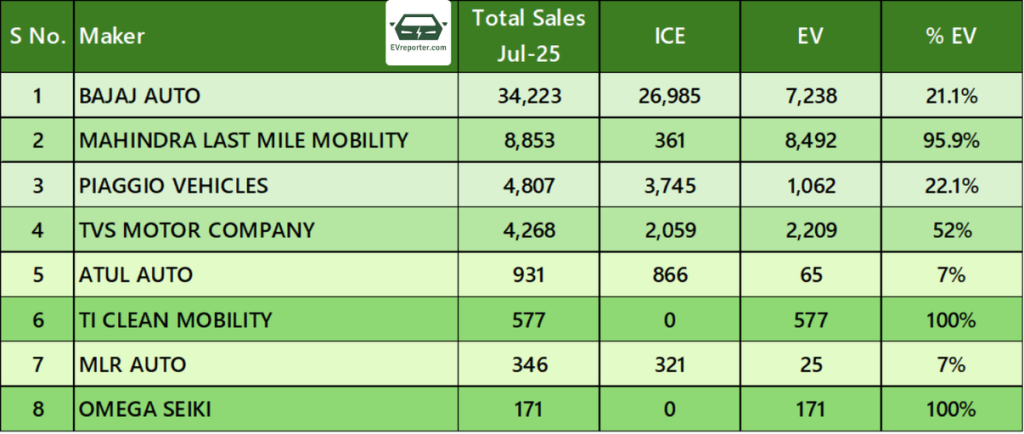

OEM wise Leading 3W L5 Pax Sales for ICE and EV, Jul 2025

Source: Vahan Dashboard as of Aug 2, 2025. Telangana Data not included.

Data as per 1386 out of 1446 RTOs across 35 out of 36 state/UTs

In July 2025, Bajaj Auto led the three-wheeler passenger market with 34,223 units, of which 21.1% were EVs. Mahindra Last Mile Mobility reported 95.9% EV penetration, followed by Piaggio Vehicles (22.1%) and TVS Motor Company (52%). Atul Auto and MLR Auto recorded 7% EV share each. TI Clean Mobility and Omega Seiki reported 100% EV sales, reflecting a fully electric portfolio.

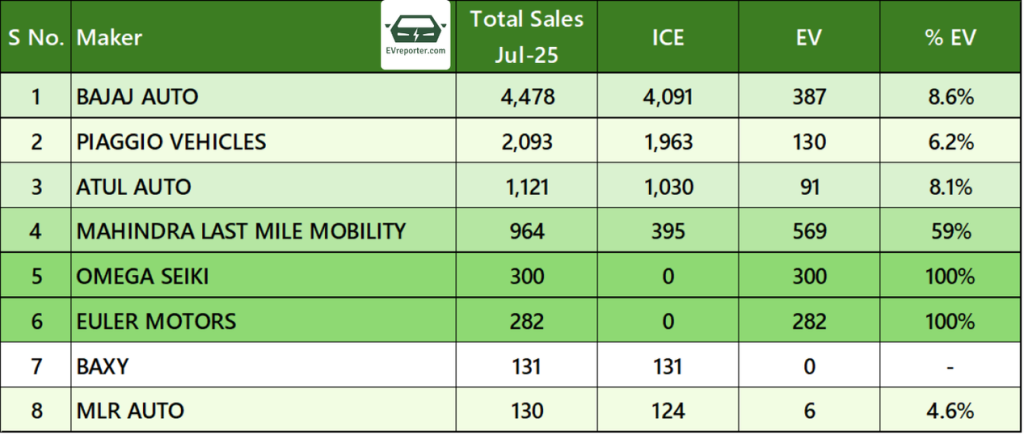

OEM wise Leading 3W L5 Goods Sales for ICE and EV, Jul 2025

Source: Vahan Dashboard as of Aug 2, 2025. Telangana Data not included.

In July 2025, Bajaj Auto led the three-wheeler cargo market with 4,478 units, of which 8.6% were EVs. Mahindra Last Mile Mobility reported the highest EV share at 59%, followed by Atul Auto (8.1%) and Piaggio Vehicles (6.2%). MLR Auto recorded 4.6% EV penetration, while Baxy remained fully ICE. Euler Motors and Omega Seiki reported 100% EV sales, reflecting their exclusive focus on electric mobility.

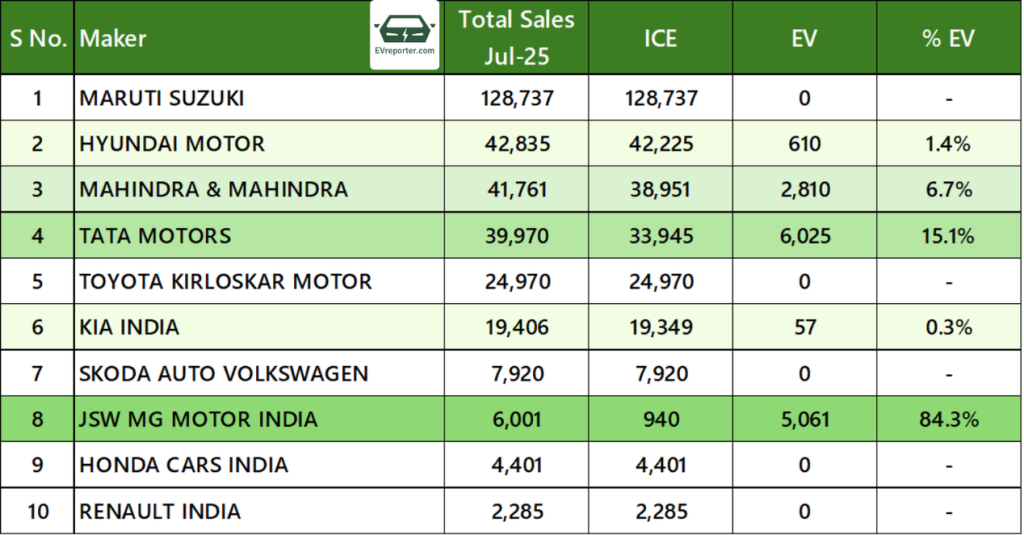

OEM wise Leading 4W Sales for ICE and EV, Jul 2025

Source: Vahan Dashboard as of Aug 2, 2025. Telangana Data not included.

Data as per 1386 out of 1446 RTOs across 35 out of 36 state/UTs

In July 2025, 4W sales were led by Maruti Suzuki with 1,28,737 units, but it had no EV presence. Tata Motors reported the highest EV share among legacy players at 15.1%, followed by Mahindra & Mahindra (6.7%) and Hyundai (1.4%). Kia India had a minimal EV share of 0.3%. JSW MG Motor India recorded the highest EV penetration at 84.3%. Toyota, Skoda, Honda, and Renault reported only ICE vehicle sales. The data highlights Tata Motors, Mahindra & Mahindra, and MG as key contributors to EV adoption in the segment.

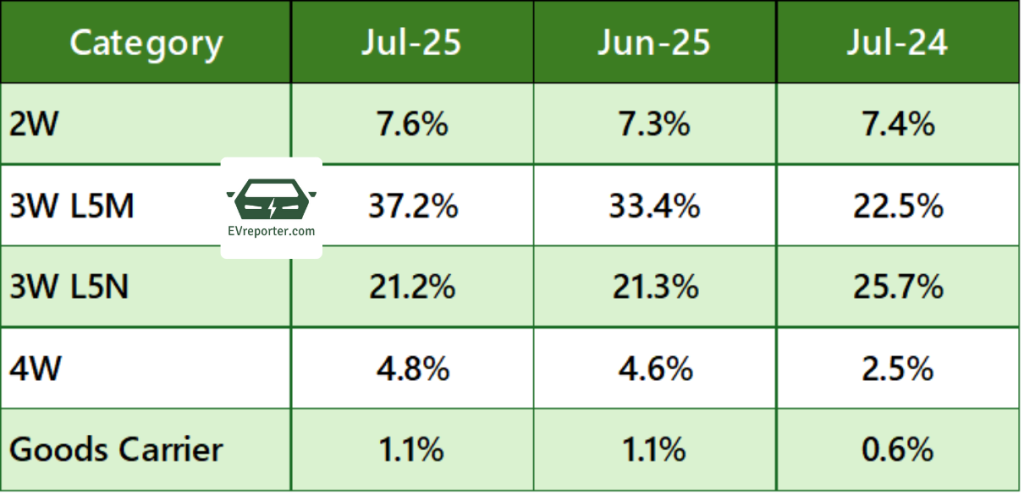

Category wise EV Penetration, Jul 2025

Source: Vahan Dashboard. Data as per 1386 out of 1446 RTOs across 35 out of 36 state/UTs

In July 2025, EV penetration across vehicle segments in India showed both month-on-month and year-on-year variations. The 2W segment increased slightly to 7.6%, up from 7.3% in June 2025 and 7.4% in July 2024. The 3W passenger (L5M) segment recorded the sharpest growth, rising to 37.2% from 33.4% in June and 22.5% in July last year. In contrast, 3W cargo (L5N) saw a marginal month-on-month dip from 21.3% in June to 21.2% in July 2025, and a year-on-year decline from 25.7% in July 2024. The 4W segment continued its upward trend, reaching 4.8% in July 2025, compared to 4.6% in June and 2.5% a year ago. EV penetration in goods carriers remained unchanged at 1.1% since June 2025, but improved from 0.6% in July 2024.

For deeper insights into India’s EV sales trends (including Telangana data) – Segment-wise, OEM-wise, city-wise, RTO-wise and state-wise – check out the EVreporter Data Portal here and subscribe.

Also read: India ICE vs EV sales | For top 2W, 3W, 4W OEMs in June 2025

Subscribe & Stay Informed

Subscribe today for free and stay on top of latest developments in EV domain.