Jupiter Electric Mobility | Tracking the progress 4 months post the launch of TEZ LCV

Jupiter Electric Mobility Pvt. Ltd. (JEM), a subsidiary of Jupiter Wagons Limited (JWL), launched its first EV – electric LCV TEZ in March 2025.

We caught up with Vivek Lohia, Managing Director – JWL, to learn about their path and progress so far. The conversation also touched upon their acquisition of Log9’s battery business. Here’s an excerpt of the responses:

How would you quantify the real-world market traction for the JEM TEZ?

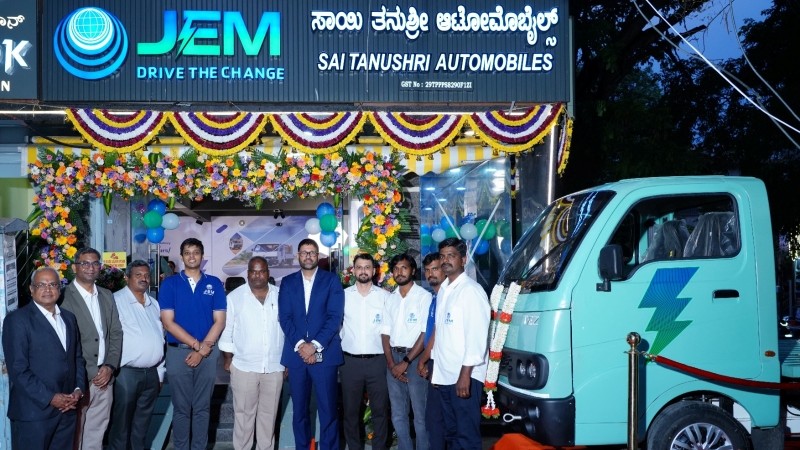

Since the launch of our flagship eLCV—TEZ in March 2025, momentum in the electric commercial vehicle market has been steadily growing, particularly in urban logistics and fleet operations. The Bangalore showroom is already operational and is proving to be an impactful and high-potential EV hub. With the showroom launch, we have facilitated direct customer engagement with vehicle demonstrations and have gathered real-time feedback, further enhancing the customer experience.

We are further looking to expand our operational efficiency with four additional dealerships. We have finalised and are nearing launch across key Tier 1 and Tier 2 cities. Also, there are rollouts planned between August and September 2025. These locations will serve to be strategic in analysing market traction, as they have demand clusters for last-mile delivery and EV fleet adoption established.

From a B2B perspective, we have been successful in onboarding three major e-commerce and grocery delivery platforms, effectively validating TEZ’s operational suitability in an urban landscape with high-frequency deliveries.

The final verdict is that TEZ has exceeded our initial projections in terms of customer traction, adoption and dealer interest. This has boosted our confidence to scale operations in emerging last-mile delivery clusters and become a key player in India’s commercial EV transition.

What attributes are cited often by drivers and fleet owners in post-delivery surveys?

JEM TEZ’s range and the total cost of ownership (TCO) have made this eLCV a standout in the market. Furthermore, both drivers and fleet operators have continually appreciated TEZ for these features, as they not only account for day-to-day operations but also help them in long-term strategy execution and fleet planning.

TEZ’s real-world range of 200 km has also eradicated any need for mid-shift charging, thus proving to be a major advantage to their target customer base of e-commerce and intra-city logistics.

You signed an MoU for 300 vehicles with Pickkup. Please share the current status and the number of vehicles that have been delivered to the fleet operator so far.

Our partnership with Pickkup has been strategic, as we plan on expanding our operations across India. Pickkup, an emerging logistics platform, operates a 100% electric fleet. We have already initiated supplies in key operational hubs such as Delhi and Chandigarh, where TEZ is on an active rollout in Pickkup’s fleet operations.

With monitoring technologies in place, the early deployments allow JEM to track vehicle performance, route alignment, and real-world efficiency closely. For the next phase of scaling, Bangalore is a prudent destination, with preparations already underway to meet the required targets, aligning with annual commitments under the MoU.

Even with the phased rollout plan, currently, we plan to ramp up the numbers in August, ensuring continuity in the supply schedule. While the exact numbers remain confidential, JEM confirms that this deployment is proceeding smoothly and in line with the strategic expectations.

The Udaan Programme with Porter was rolled out pre-launch. How is it shaping up?

This programme aims to serve as a pilot platform for exploring opportunities in scale-focused deployment models and financing solutions tailored for fleet drivers and small business operators. Since then, we have made significant progress in building a tailored institutional financing channel. This helped us initiate structured deliveries under this programme, with Porter and other aggregators in the market leveraging OEM-backed financing for hassle-free fleet integration.

However, the programme is still in the nascent stages of development, with its core retail financing component—a feature that will empower individual driver partners and owner-operators—still in its final developmental stage. We are also actively in talks with financing partners, trying to stabilise retail credit channels, which will further help individual drivers and fleet operators by aligning lending norms, risk coverage, and process efficiency.

The retail financing channel of JEM is set to become operational within the next one to two months. Once launched, it will significantly broaden the programme’s reach, facilitating access to electric vehicles for individuals under the Udaan framework.

You acquired Log9’s battery division in October 2024. Can you comment on the synergies for this acquisition and if JEM’s traction battery is now being produced at this division?

Log9’s battery division acquisition was done through a business asset transfer in October 2024. This investment has allowed us to take full control of the traction battery manufacturing. The company can now also ensure its compliance with various factors of battery efficiency, quality assurance, and supply chain efficiency—factors deemed critical for a commercial EV manufacturer.

Consequently, we are now producing traction batteries at the new manufacturing facility, enhancing the company’s production consistency, scale, and turnaround time for vehicle delivery.

Furthermore, this acquisition has also opened new verticals for us, with the company now venturing into the railway battery segment and the commercial and industrial battery energy storage systems (C&I BESS).

The Pithampur line is currently rated at 8,000–10,000 units per annum. What utilisation level have you hit in the first four months?

The Pithampur manufacturing facility is currently in its early operational phase. Since the launch, our primary focus has been on establishing a stable and scalable production rhythm, with a strong emphasis on cost and quality. At this stage, we are targeting a production milestone of 100 vehicles per month as the initial scale benchmark. This phased ramp-up is deliberate, ensuring that each unit meets our quality standards and performance expectations before we expand further.

To support these scaling strategies, we are actively working to refine the supply chain processes, which include an optimised lead time, the establishment of a reliable procurement cycle, and the onboarding of strategic suppliers. Furthermore, we have enhanced our internal operations in critical manufacturing, which has enabled us to improve quality control and minimise dependence on external vendors.

What is the current priority and area of focus for you at JEM and your outlook for the rest of this year?

At this stage of our growth journey, our top priority at Jupiter Electric Mobility (JEM) is to establish robust and scalable channels for both sales and after-sales service. Ensuring that customers—particularly fleet operators—receive dependable service support is key to driving long-term adoption and satisfaction in the commercial EV segment. Alongside this, we are working on making tailored financing options available that are well-suited to our customer profiles, especially in a segment where upfront cost remains a barrier for many.

Our current sales strategy is sharply focused on fleet and institutional clients. This allows for concentrated deployments and controlled service management. This targeted approach not only ensures operational efficiency but also helps us build the right base before we scale into the more fragmented retail segment.

The remainder of this financial year will be dedicated to consolidating these core enablers—service

readiness, strategic financing, and structured B2B sales. These efforts are intended to create a strong, stable platform from which JEM can expand into retail markets with greater confidence and efficiency. Our outlook remains positive, with steady growth driven by disciplined execution and a deep understanding of commercial EV needs.

This interview was first published in EVreporter Aug 2025 magazine.

Also read: Jupiter Electric Mobility and Pickkup partner for 300 e-LCV fleet

Subscribe today for free and stay on top of latest developments in EV domain.