India’s Electric Vehicle Market: 2.3 million units and counting – CY 2025 annual insights

The Indian automotive landscape underwent a definitive shift in 2025, as electric vehicle (EV) sales surpassed 2.36 million units.

Representing 8.36% of overall automobile sales, the sector recorded a Year-on-Year growth of 16.62%, moving beyond early adoption into a phase of diverse, segment-led expansion.

As the market matures, the EVreporter Annual Report CY-2025 provides the definitive data-driven roadmap to this transition. This article is a preview of the critical trends and segment shifts uncovered in the full report.

Source for all data, tables and graphs in the CY 2025 report: EVreporter Intelligence Vahan Dashboard Data and Telangana Regional Transport portal.

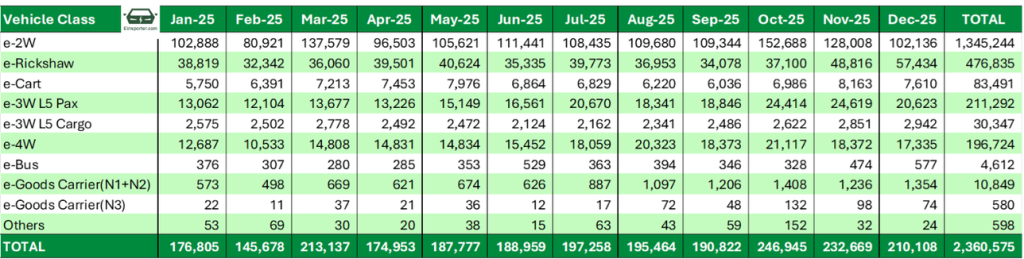

Note – Low-speed e-2W data not included. ‘Others’ category includes Forklift, Adapted Vehicle, Crane mounted vehicle etc. ‘Goods Carrier’ refers to cargo vehicles, including LCVs and HGVs (N1, N2, N3), as categorised in the Vahan dashboard. ‘E-rickshaw’ refers to low-speed electric 3Ws (up to 25 kmph) used for passenger transportation. ‘E-cart’ designates low-speed electric 3Ws (up to 25 kmph) used for goods transportation.

India EV Sales – CY 2025 | Month-wise Sales

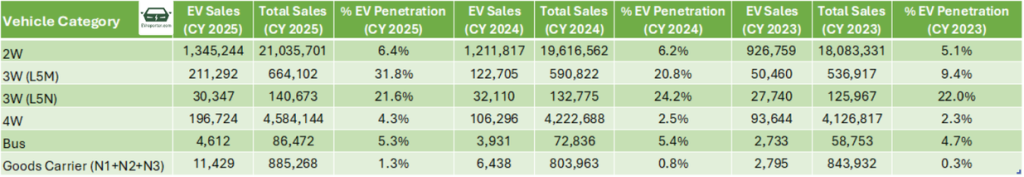

Vehicle Category-wise EV Penetration in CY 2025 vs 2024 vs 2023

Segment Shifts: The Rise of Passenger Three-Wheelers and Cars

While high-speed electric two-wheelers (e-2Ws) continue to lead by volume—capturing the largest segment share with 1,345,244 units sold—other categories are experiencing rapid EV penetration.

3W Passenger (L5M): This segment emerged as the star performer, with EV penetration leaping from 20.8% in 2024 to 31.8% in 2025. Momentum peaked in December 2025, when nearly 39% of all passenger three-wheelers sold were electric.

Cargo 3Ws (L5N): Conversely, the cargo segment saw a decline in penetration, falling to 21.6% from 24.2% the previous year.

Electric Four-Wheelers (e-4W): Passenger cars saw a sharp rise to 4.3% penetration, with 196,724 units registered—an impressive 85.1% YoY growth.

Electric Passenger Cars: The Rise of Choice and Competition

- The four-wheeler (e-4W) segment matured rapidly in 2025, recording 85.1% YoY growth with 196,724 registrations. EV penetration in this category climbed to 4.3%, up from 2.5% in 2024.

- The competitive landscape for cars is no longer a one-horse race. While Tata Motors maintained its lead with 76,899 units, its market share contracted from 61.2% in 2024 to 39.1% in 2025. This shift was driven by the aggressive growth of Mahindra & Mahindra (396% YoY growth) and JSW MG Motor (143.2% YoY growth), both of which significantly increased the share of EVs in their portfolios.

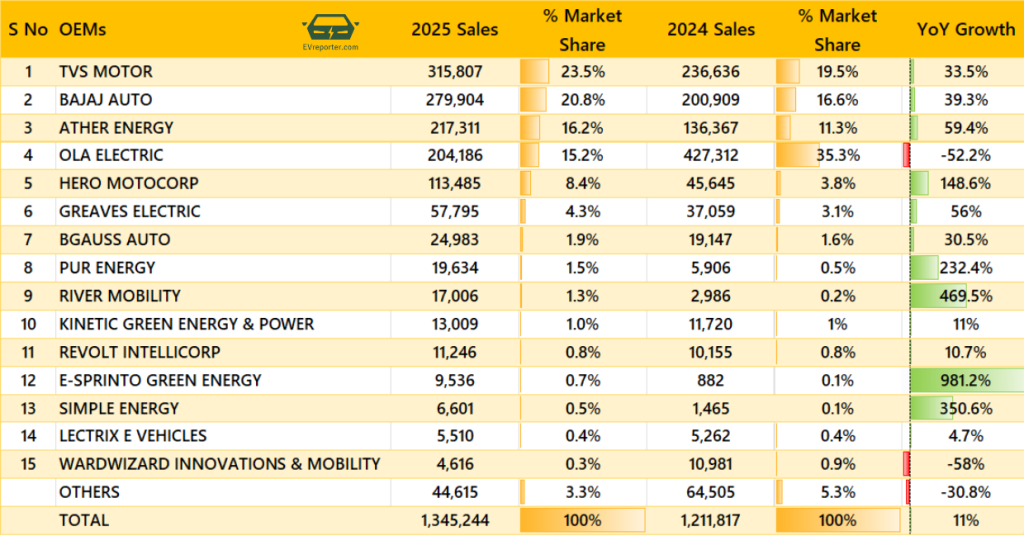

Electric Two-Wheelers: The OEM Re-Shuffle

In the e-2W segment, which accounted for 56.99% of all EV sales, the hierarchy was flipped:

- TVS Motor registered its highest-ever e-2W sales, securing a 23.5% market share, followed by Bajaj Auto and Ather Energy.

- Ola Electric saw its market share more than halve, falling from 35.3% to 15.2%, slipping from first to fourth place.

- Emerging players like River Mobility and E-Sprinto recorded exceptional growth, with River’s sales jumping from roughly 3,000 to over 17,000 units.

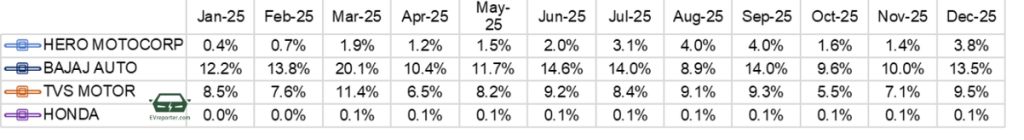

Top Indian 2W OEMs | EV Share in Respective Monthly Sales Over 2025

Top Cities | e-2W sales in 2025

Buses and Commercial Vehicles

- Electric buses ended the year with a monthly penetration high of 9.2% in December, led by Olectra Greentech and PMI Electro Mobility. The overall EV penetration in the segment for CY 2025 was 5.3%. Delhi, Nagpur and Mumbai were the top 3 cities for e-bus registrations.

- The Electric Goods Carriers Segment (N1, N2, N3) is in its early growth phase. The segment recorded a 77.52% YoY sales increase, with Maharashtra leading among all states.

Tracking Regional Growth

EV adoption is not uniform across India, and the report identifies the specific states and cities driving the numbers:

- Sales Volume Drivers: Uttar Pradesh remains the top contributor to total Indian EV sales, accounting for 17.15% of total Indian EV sales, largely due to its massive e-rickshaw base.

CY 2025 – Segment-wise Sales in Top EV States in India

- Penetration Leaders: For the highest EV penetration relative to total sales, Tripura (18.27%), Assam (14.3%), and Delhi (13.91%) lead the nation.

- Growth Hotspots: West Bengal exhibited the highest YoY EV sales growth (121.3%) among the top 10 states.

- City Leaders: Bengaluru solidified its status as the e-2W capital with 90,215 sales, while Delhi holds the highest EV penetration in the e-bus segment at 49.18%.

This article is a preview of a few sections of EVreporter CY 2025 Report. The full 37-page report is available on the EVreporter Data Portal.

Annual subscription of EVreporter Data Portal – INR 35,000+GST

Not ready to subscribe yet? Get the CY 2025 report

Subscribe & Stay Informed

Subscribe today for free and stay on top of latest developments in EV domain.