India ICE vs EV sales | For top 2W, 3W, 4W OEMs in May 2025

In May 2025, the overall penetration of electric vehicles (EVs) in India’s 2-wheeler market was 6.1%. For passenger 3W L5 autos, it was 32.9%, for cargo 3W L5 autos, it was 23.6%, and for 4W, it was 4.1%.

This article aims to showcase the EV sales of top OEMs compared to their overall vehicle sales in the 2W, 3W, and 4W categories.

Also Read: Overall EV sales in May 2025

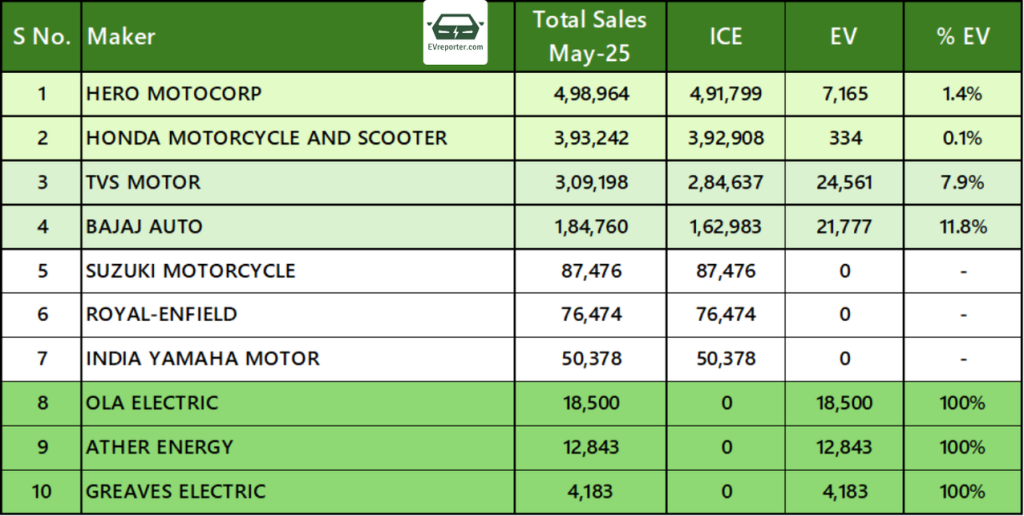

OEM wise Leading 2W Sales for ICE and EV, May 2025

Source: Vahan Dashboard as of June 2, 2025. Telangana Data not included.

In May 2025, the two-wheeler market in India continued to show a blend of ICE and EV sales. Hero MotoCorp led overall sales with 4,98,964 units, though only a small fraction (1.4%) came from EVs. Honda Motorcycle and Scooter, while second in total sales (3,93,242 units), had a minimal EV presence at 0.1%. TVS Motor (7.9%) and Bajaj Auto (11.8%) demonstrated more notable EV adoption. Suzuki Motorcycle, Royal-Enfield, and India Yamaha Motor remained entirely dependent on ICE sales, recording zero EV sales. Pure EV players Ola Electric (18,500 units), Ather Energy (12,843 units), and Greaves Electric (4,183 units) maintained 100% EV sales.

Overall EV penetration in the 2W segment in May 2025 was 6.1%, up from 5.5% in April 2025.

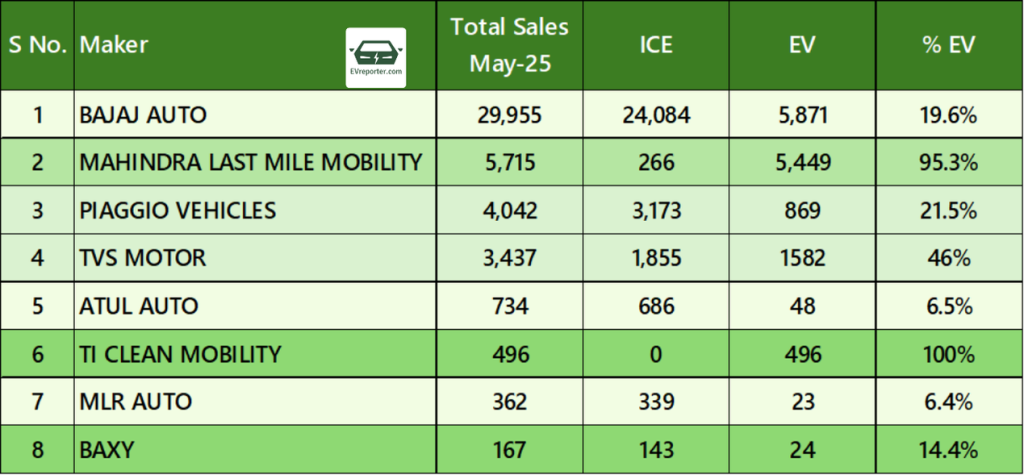

OEM wise Leading 3W L5 Pax Sales for ICE and EV, May 2025

Source: Vahan Dashboard. Data as per 1385 out of 1445 RTOs across 35 out of 36 state/UTs

In May 2025, Bajaj Auto dominated the three-wheeler market with 29,955 units sold, with EVs accounting for 19.6% of their sales. Mahindra Last Mile Mobility showcased a strong commitment to electric mobility with 95.3% EV adoption (out of 5,715 total sales), while Piaggio Vehicles (21.5%) and TVS Motor (46%) also showed significant EV penetration. Atul Auto (6.5%), MLR Auto (6.4%), and Baxy (14.4%) had a smaller share of EVs in their total sales. Notably, TI Clean Mobility recorded 100% EV sales, underscoring their exclusive focus on electric three-wheelers.

Overall EV penetration in pax 3W auto (L5) segment in May 2025 was 32.9%, up from 30.9% in April 2025.

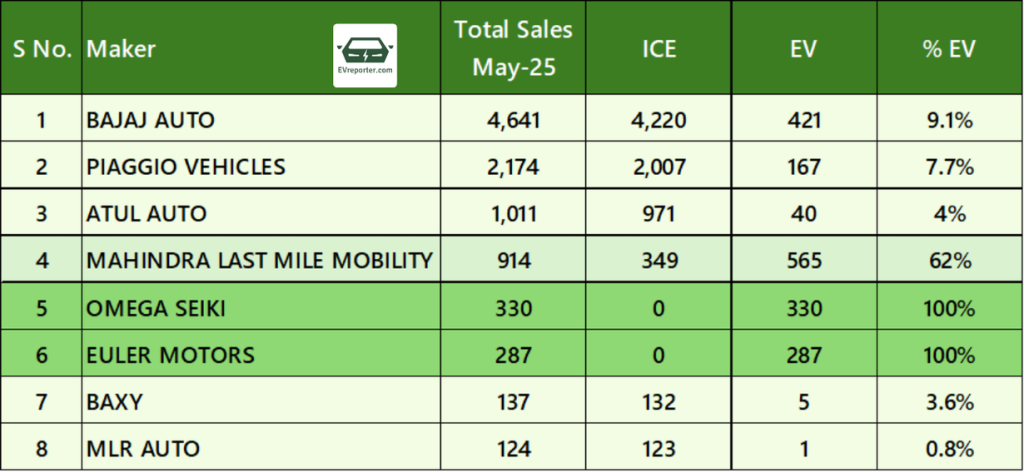

OEM wise Leading 3W L5 Goods Sales for ICE and EV, May 2025

Source: Vahan Dashboard as of June 2, 2025. Telangana Data not included.

In May 2025, Bajaj Auto led the three-wheeler cargo market with 4,641 units, with EVs making up 9.1% of their sales. Mahindra Last Mile Mobility showcased the highest EV share at 62% (out of 914 total sales). Piaggio Vehicles (7.7%), Atul Auto (4%), Baxy (3.6%), and MLR Auto (0.8%) had a smaller proportion of EVs in their sales. Meanwhile, Omega Seiki (330 units) and Euler Motors (287 units) recorded 100% EV sales, reinforcing their dedication to electric mobility.

Overall EV penetration in the 3W goods (L5) segment in May 2025 was 23.6%, slightly up from 23.4% in April 2025.

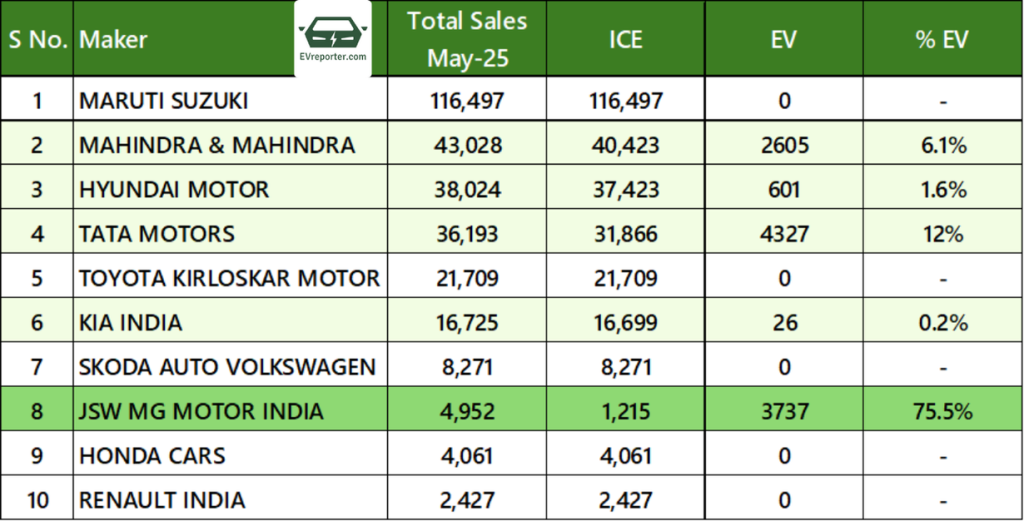

OEM wise Leading 4W Sales for ICE and EV, May 2025

Source: Vahan Dashboard. Data as per 1385 out of 1445 RTOs across 35 out of 36 state/UTs

In May 2025, 4W sales were led by Maruti Suzuki with 1,16,497 units, but they had no EV presence. Tata Motors (12%) and Mahindra & Mahindra (6.1%) showed notable EV adoption. JSW MG Motor India had the highest EV share at a significant 75.5%. Hyundai Motor (1.6%) and Kia India (0.2%) had limited EV sales, whereas Toyota Kirloskar Motor, Skoda Auto Volkswagen, Honda Cars, and Renault India remained ICE-only. The data highlights Tata, Mahindra, and JSW MG Motor India as key players driving EV penetration in the segment.

Overall EV penetration in the 4W segment in May 2025 was 4.1%, up from 3.5% in April 2025.

For deeper insights into India’s EV sales trends (including Telangana data) – Segment-wise, OEM-wise, city-wise, RTO-wise and state-wise – check out the EVreporter Data Portal here and subscribe.

Also read: India ICE vs EV sales | For top 2W, 3W, 4W OEMs in April 2025

Subscribe & Stay Informed

Subscribe today for free and stay on top of latest developments in EV domain.