India ICE vs EV sales | For top 2W, 3W, 4W OEMs in February 2025

In February 2025, the overall penetration of EVs in the 2W market was 5.6%. For passenger 3W L5 autos, it was 26.7%, for cargo 3W L5 autos, it was 22.6% and for 4W, it was 2.9%. This article aims to showcase where EV sales stand compared to the overall vehicle sales for top OEMs in the 2W, 3W and 4W categories.

Also Read: Overall EV sales in February 2025

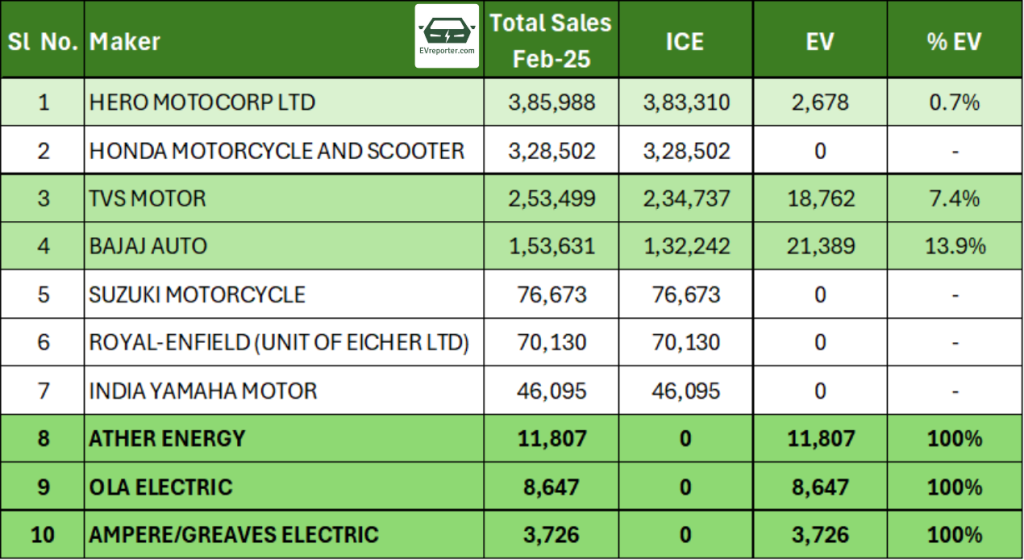

India’s Top 2W OEMs | ICE vs EV Sales for Feb 2025

In February 2025, Hero MotoCorp led overall 2W sales with 3,85,988 units, but EVs comprised only 0.7% (2,678 units) of its total. Honda Motorcycle and Scooter India followed with 3,28,502 units, but recorded no EV sales. Among legacy brands, TVS Motor and Bajaj Auto showed notable EV adoption, with electric models comprising 7.4% (18,762 units) and 13.9% (21,389 units) of their respective sales. Suzuki, Royal Enfield, and Yamaha remained ICE-only. Meanwhile, EV-only manufacturers Ather Energy (11,807 units), Ola Electric (8,647 units), and Ampere/Greaves Electric (3,726 units) reported 100% EV sales.

OEM wise Leading 3W L5 Pax Sales for ICE and EV, Feb 2025

Source: Vahan Dashboard as of March 3, 2025. Data as per 1378 out of 1438 RTOs across 35 out of 36 state/UTs

In February 2025, Bajaj Auto led the three-wheeler passenger market with 29,823 units, of which 13.9% (4,156 units) were electric. Mahindra Last Mile Mobility followed with 5,009 units, achieving an impressive 94.5% EV penetration (4,732 units). Piaggio Vehicles reported 4,302 units, with 24.4% (1,049 units) being electric, while TVS Motor recorded 2,400 sales, with EVs contributing 12.9% (309 units). Atul Auto sold 748 units, with an EV share of 7.6% (57 units), whereas Omega Seiki (571 units) and TI Clean Mobility (532 units) were 100% electric. MLR Auto, with 419 total sales, had an EV penetration of 7.4% (31 units).

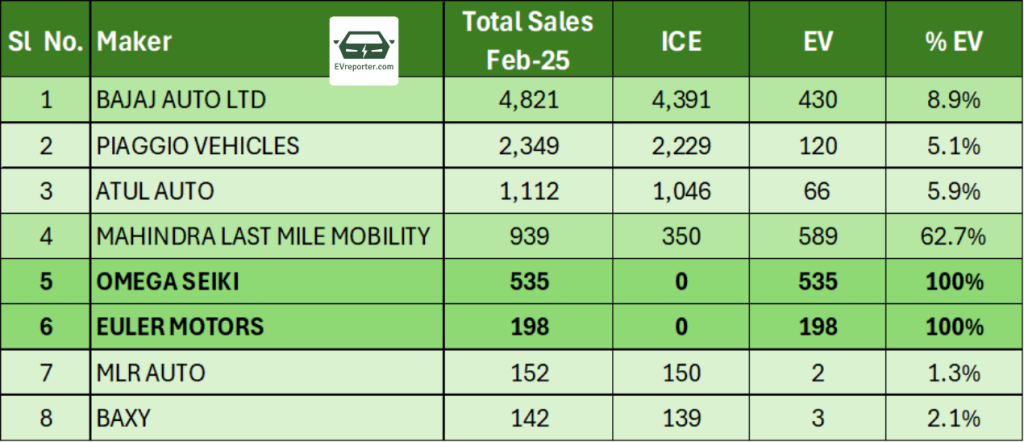

OEM wise Leading 3W L5 Goods Sales for ICE and EV, Feb 2025

In February 2025, Bajaj Auto led the three-wheeler goods segment with 4,821 units, of which 8.9% (430 units) were electric. Piaggio Vehicles followed with 2,349 units, recording 5.1% EV penetration (120 units), while Atul Auto sold 1,112 units with 5.9% (66 units) being electric. Mahindra Last Mile Mobility saw the highest EV adoption among major players, with 62.7% (589 out of 939 units) being electric. Fully electric manufacturers Omega Seiki (535 units) and Euler Motors (198 units) reported 100% EV sales. MLR Auto and Baxy remained predominantly ICE-focused, with EV shares of 1.3% (2 units) and 2.1% (3 units), respectively.

OEM wise Leading 4W Sales for ICE and EV, Feb 2025

Source: Vahan Dashboard as of March 3, 2025. Data as per 1378 out of 1438 RTOs across 35 out of 36 state/UTs

In February 2025, Maruti Suzuki led 4W sales with 1,18,070 units, but had no EV presence. Mahindra & Mahindra sold 39,560 units, with 1.2% (479 units) being electric. Tata Motors recorded 38,386 units, with 10% (3,823 units) from EVs, while Hyundai Motor saw 1.9% (738 EVs) out of 38,121 units. Toyota, Skoda, Honda, and Renault reported no EV sales. Kia India had a minimal EV share at 0.1% (19 units out of 18,787). MG Motor India led in EV adoption among mainstream brands, with 71.8% (3,269 out of 4,550 units) being electric.

For deeper insights into India’s EV sales trends (including Telangana data) – Segment-wise, OEM-wise, city-wise, RTO-wise and state-wise – check out the EVreporter Data Portal here and subscribe.

Also read: India ICE vs EV sales for top 2W, 3W and 4W OEMs in January 2025

Subscribe & Stay Informed

Subscribe today for free and stay on top of latest developments in EV domain.