India ICE vs EV sales | For top 2W, 3W, 4W OEMs in August 2025

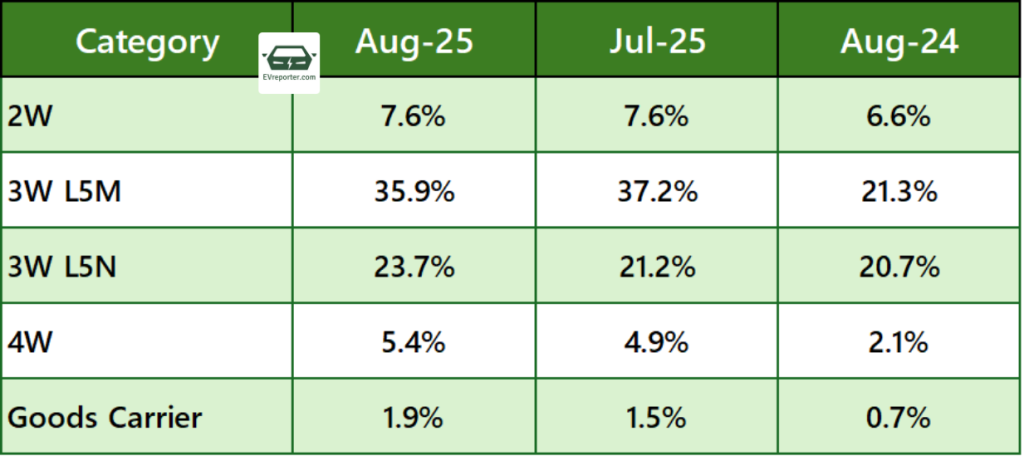

In August 2025, the overall penetration of EVs in the 2W market was 7.6%. For passenger 3W L5 autos, it was 35.9%, and for cargo 3W L5 autos, it was 23.7% and for 4W, it was 5.4%. This article aims to showcase where EV sales stand compared to the overall vehicle sales in the 2W, 3W, and 4W categories.

Also Read: Overall EV sales in August 2025

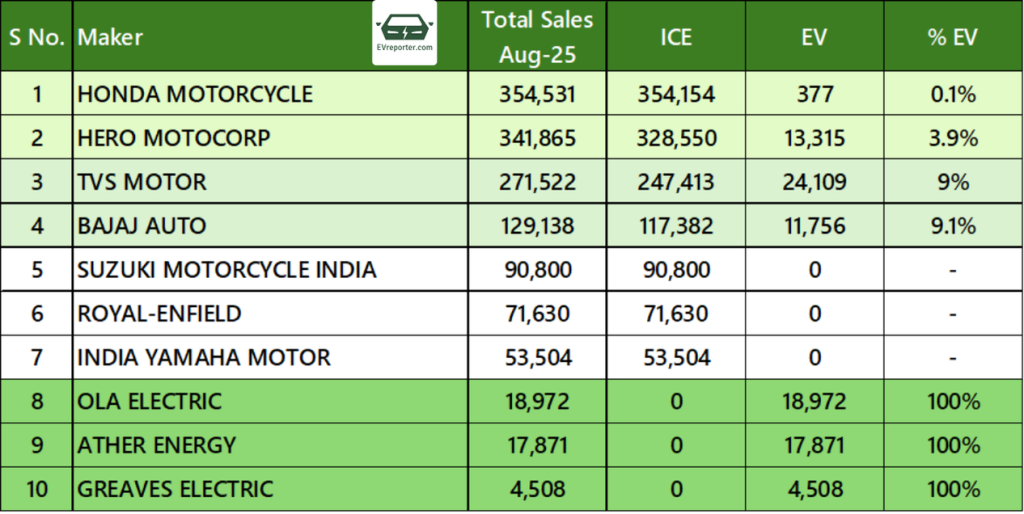

OEM wise Leading 2W Sales for ICE and EV, Aug 2025

In August 2025, the two-wheeler market was led by Honda Motorcycle (3,54,531 units) and Hero MotoCorp (3,41,865 units), though EVs contributed only 0.1% and 3.9% of their sales, respectively. TVS Motor (9%) and Bajaj Auto (9.1%) recorded higher EV penetration. Suzuki, Royal Enfield, and Yamaha continued to be fully ICE-dependent. Among pure EV players, Ola Electric (18,972), Ather Energy (17,871), and Greaves Electric (4,508) achieved 100% EV sales.

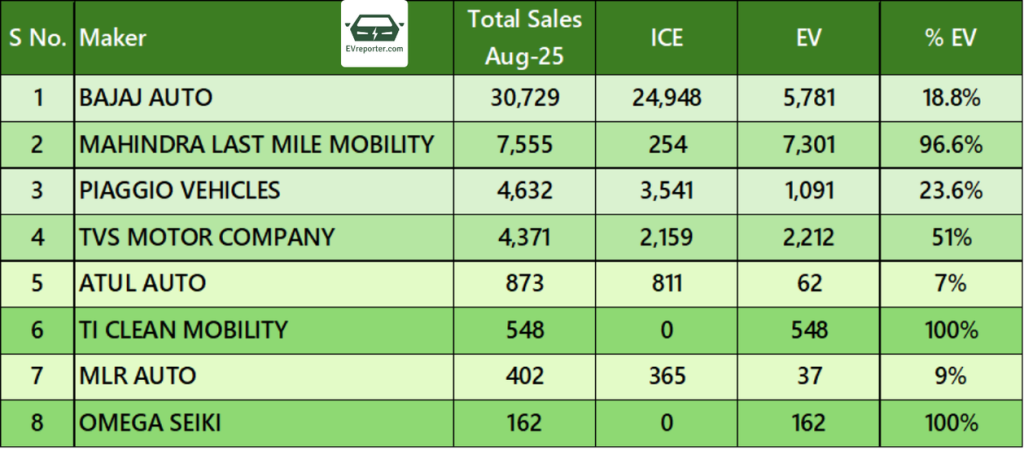

OEM wise Leading 3W L5 Pax Sales for ICE and EV, Aug 2025

Source: Vahan Dashboard as of Sep 2, 2025. Telangana Data not included.

Data as per 1391 out of 1451 RTOs across 35 out of 36 state/UTs

In August 2025, Bajaj Auto led the three-wheeler passenger market with 30,729 units, of which 18.8% were EVs. Mahindra Last Mile Mobility showed very high EV penetration at 96.6%, while Piaggio (23.6%) and TVS Motor (51%) also reported strong EV adoption. Atul Auto (7%) and MLR Auto (9%) had lower EV shares. TI Clean Mobility (548) and Omega Seiki (162) reported 100% EV sales.

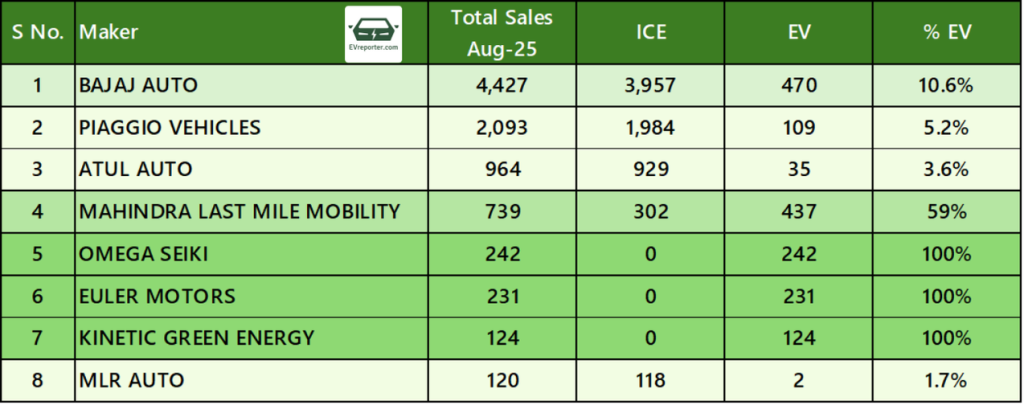

OEM wise Leading 3W L5 Goods Sales for ICE and EV, Aug 2025

In August 2025, Bajaj Auto led the three-wheeler cargo market with 4,427 units, of which 10.6% were EVs. Mahindra Last Mile Mobility followed with 739 units, showing 59% EV penetration. Piaggio (5.2%), Atul Auto (3.6%), and MLR Auto (1.7%) had relatively low EV adoption. Meanwhile, Omega Seiki (242), Euler Motors (231), and Kinetic Green Energy (124) reported 100% EV sales.

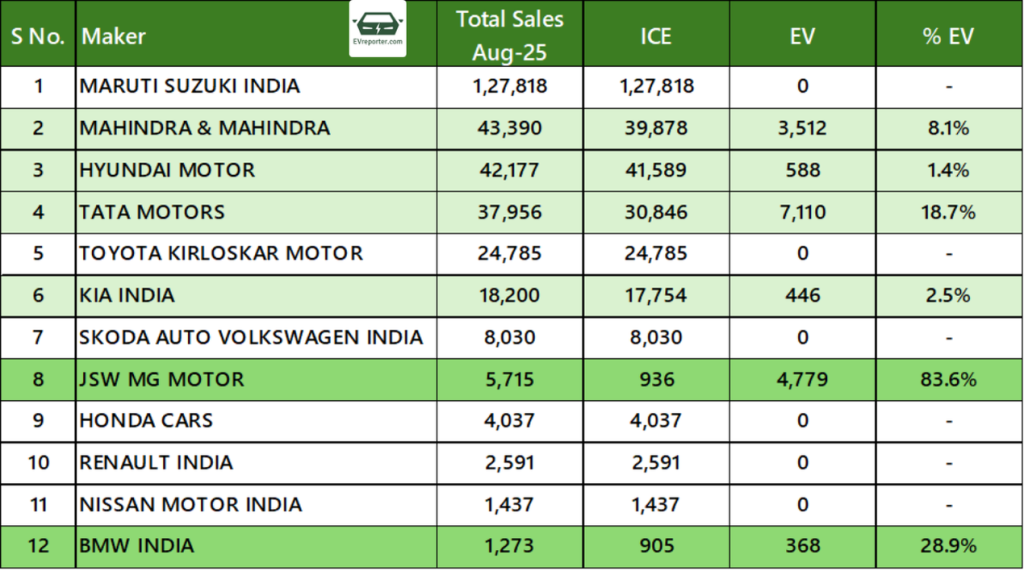

OEM wise Leading 4W Sales for ICE and EV, Aug 2025

Source: Vahan Dashboard as of Sep 2, 2025. Telangana Data not included.

Data as per 1391 out of 1451 RTOs across 35 out of 36 state/UTs

In August 2025, 4W sales were led by Maruti Suzuki with 1,27,818 units, but with no EV presence. Tata Motors (18.7%) and Mahindra & Mahindra (8.1%) showed significant EV adoption, while JSW MG Motor had the highest EV share at 83.6%. BMW India also reported a notable 28.9% EV share. Hyundai (1.4%) and Kia (2.5%) had limited EV penetration, whereas Toyota, Skoda, Honda, Renault, and Nissan remained fully ICE-dependent.

Category wise EV Penetration, Aug 2025

Source: Vahan Dashboard. Data as per 1391 out of 1451 RTOs across 35 out of 36 state/UTs

In August 2025, EVs made up 7.6% of 2W sales (flat vs July, up from 6.6% last year). EV share in 3W passenger was 35.9% (down from 37.2% in July, but well above 21.3% last year), and in 3W cargo 23.7% (up from 21.2% in July and 20.7% last year). For 4Ws, EVs reached 5.4% (vs 4.9% in July, 2.1% last year), while goods carriers stood at 1.9% (up from 1.5% in July and 0.7% a year ago).

For deeper insights into India’s EV sales trends (including Telangana data) – Segment-wise, OEM-wise, city-wise, RTO-wise and state-wise – check out the EVreporter Data Portal here and subscribe.

Also read: India ICE vs EV sales | For top 2W, 3W, 4W OEMs in July 2025

Subscribe today for free and stay on top of latest developments in EV domain.