Revised GST slabs to benefit the automotive sector, boost domestic sales

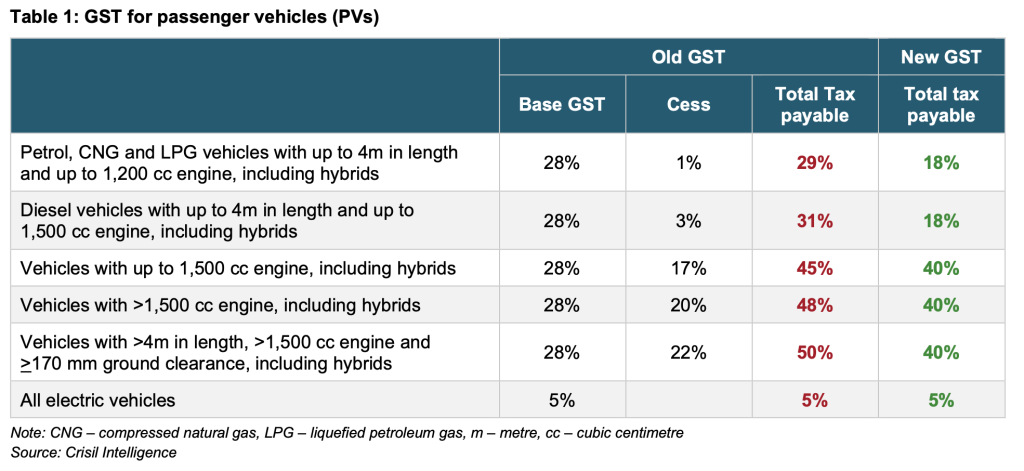

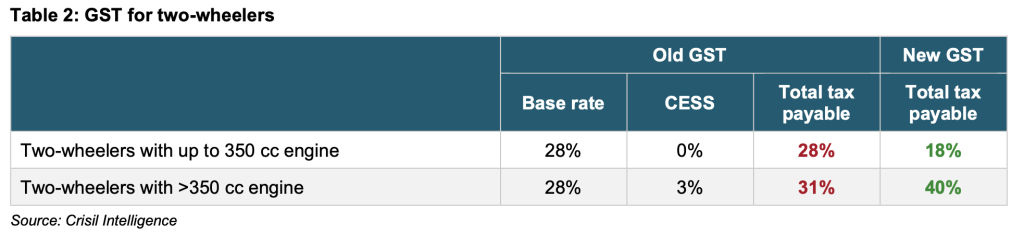

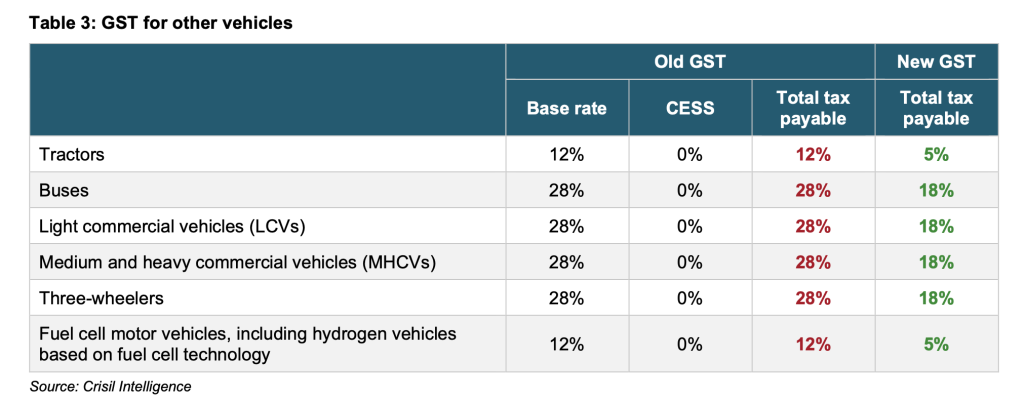

The Government of India has revamped the Goods and Services Tax (GST) structure with three slabs of 5%, 18% and 40%. In the automobile industry, electric vehicles will continue to be taxed at 5%, while other segments have undergone a rate revision to either 18% or 40% (see tables below).

Impact of GST revision on vehicle prices

Passenger Vehicles

In the case of internal combustion engine (ICE) and hybrid vehicles, prices of entry-level hatchbacks (e.g., Wagon R), premium hatchbacks (e.g., Swift), compact sedans (e.g., Swift Dzire), and sub-compact sport utility vehicles (SUVs) with <1,200 cc petrol or <1,500 cc diesel engines (e.g., Punch) will decline about 8.5%.

Meanwhile, prices of large sedans (e.g., Virtus), compact SUVs (e.g., Brezza), mid-SUVs (e.g., Creta), and multi-purpose vehicles (MPVs) with <1,500 cc engines (e.g., Ertiga) will reduce by about 3.5%.

Further, prices of premium SUVs (e.g., XUV 7OO) and MPVs with >1,500 cc engines (e.g., Innova) will fall about 6.7%.

Two-wheelers

In the case of ICE two-wheelers, prices of almost all categories, except one, will reduce by about 7.8%. Prices of premium two-wheelers with >350 cc engine will increase about 6.9%.

Other vehicles

For internal combustion vehicles

In the case of ICE tractors and fuel cell motor vehicles, including hydrogen vehicles, prices will decline by about 6.3%. Meanwhile, prices of three-wheelers, LCVs, MHCVs and buses will reduce by about 7.8%.

The above analysis across segments does not consider any pass-through that may happen from automotive component manufacturers to original equipment manufacturers (OEMs) in the form of GST reduction, as all automotive components have been brought under the ambit of 18%.

For a domestic sales perspective, in fiscal 2026, PVs may see a marginal uptick (lower single-digit growth), while two-wheelers could see higher single-digit growth. Tractors will see a continued traction with 4-7% growth, while CVs may see flattish-to-marginal-positive growth.

The automotive aftermarket segment will also benefit as all components will now be brought under the 18% GST slab, thereby leading to a reduction in prices of components taxed at 28% by about 7.8%.

Impact on the road freight transportation industry

The overall GST on multimodal logistics has been reduced to 5% from 12%, leading to a reduction in costs, especially for exporters. The reduction in third-party insurance on goods carriages from 12% to 5% will also lead to a decline in operating costs for transporters. The 5% tax without ITC continues, which will not have an impact on small fleet operators. Meanwhile, large fleet operators will not have to pay 18% GST with ITC instead of 12% GST with ITC.

In the short term, the input credit for LFOs may be impacted until a full cycle is completed, which may affect their purchases in the near term.

The inputs are attributed to Hemal Thakkar, Senior Practice Leader and Director – Consulting, Crisil Intelligence.

Also read: Unplugging incentives: The consequences of waiving EV road tax exemptions

Subscribe & Stay Informed

Subscribe today for free and stay on top of latest developments in EV domain.