Rare-earth-free Reluctance Motors for Electric Vehicles | Chara Technologies

90% of the rare-earth magnet supply is controlled by one country; they are expensive, and extraction is environmentally damaging. Chara Technologies has developed synchronous reluctance motors that eliminate reliance on rare-earth magnets. This 200-year-old technology was previously impractical due to control difficulties, but modern algorithms have overcome the challenges posed by nonlinearity, says Bhaktha Keshavachar, Co-Founder & CEO at Chara Technologies. The excerpts from the interaction are shared in this Q&A.

What are the possible paths away from EV motors’ heavy rare-earth dependency?

There are three possible paths to address the dependency on imported rare-earth magnets:

- Building our own rare-earth capabilities: One approach is for countries like India to invest in mining, extraction, and magnet manufacturing. The Government of India has already announced a billion-dollar scheme to support these areas. Rare earths aren’t just for EV motors—they’re also needed in medical electronics, defence, semiconductor processing, and many other applications. So this investment is essential, though it will take several years to show results.

- Developing non–rare-earth magnets: Another approach is to create powerful magnets without rare earths. For example, Niron Magnetics in Minnesota, USA is working on iron-nitride magnets, while Europe is developing potassium / strontium magnets. These could eventually match the strength of current rare-earth magnets, but material science breakthroughs typically take about a decade to reach production, so this will take time.

- Adopting motor technologies that don’t use rare-earth magnets: We believe every problem has a technical solution. There are motor architectures, such as reluctance motors and externally excited synchronous motors, that do not require rare-earth magnets. We believe this technology-driven approach will be viable for at least the next decade and a half, given how hard it is to predict what comes after that.

You are working on the third pathway, which eliminates magnets altogether. Tell us about your motor technology.

Yes, we use reluctance motor technology. This is a well-known concept. The original work dates back almost 200 years, around 1835, when electricity and magnetism were first being explored. These were among the earliest motor concepts proposed, but they were never widely adopted due to several challenges: high nonlinearity, difficult control, lower power density, and torque ripple.

Now, with the need for sustainable and efficient motors at scale due to the energy transition, many companies, including us, are revisiting these alternative technologies. We started CHARA — which means “motion” in Sanskrit — about six years ago, during COVID. From day one, we were focused on solving three problems:

- Develop a sustainable motor without dirty chemical processes.

- Eliminate dependence on critical minerals controlled by foreign countries.

- Build motors and controllers designed in India from first principles, rather than relying on imports or large MNCs. We wanted to create a true “Bharat motor.”

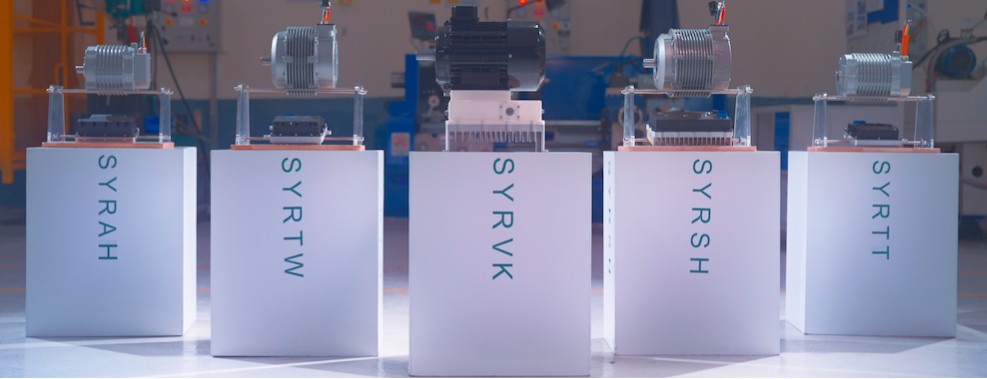

Over the past six years, that’s what we’ve been doing, and now we are entering the production and deployment phase of our rare-earth-free motors.

If we compare your technology as it stands today, how does it perform against PMSMs in terms of performance, efficiency, and cost?

Almost all traction motors used today—from the smallest e-bikes to vehicles from companies like Ather and even Tesla—use PMSMs with the same type of magnets. They work extremely well and are among the best motors available today.

Our motors, which we are now offering in the 6 kW to 30 kW range, match PMSMs in performance. In terms of efficiency, they are as efficient as, and in some cases slightly better, especially when you look at duty-cycle efficiency. Torque and power performance are also on par with PMSMs. On cost, about 40% of a PMSM motor’s cost comes from magnets. Since we eliminate magnets and instead use a bit more steel and copper, our motors are approximately 15% cheaper, +/- 5%, depending on the motor size—compared to PMSM motors.

Are there any trade-offs that don’t work in your favour—such as size or weight?

Yes, this comes down to physics. We’ve removed very powerful magnets and added more steel and copper to compensate for the magnetic flux. That extra steel and copper add weight and size. As a result, our motors are typically about 10–15% heavier than comparable PMSM motors. This is a known and accepted trade-off.

For example, for e-3Ws, we offer a 6 kW-rated, 10 kW-peak motor operating at 48–96 volts. A comparable PMSM motor from a well-known supplier weighs around 15 kg, while our motor weighs about 18 kg, a roughly 15% difference. The GVW of a three-wheeler is nearly 750 kg. An extra 3 kg on the motor is a very small fraction of that. With current geopolitical considerations, customers are increasingly willing to accept this trade-off. Several companies are already using our motors; some are homologated and moving into production.

We are at the early stage of this technology transition to reluctance motors. We are already working on version 1.5, which should reduce the weight gap from 15% to about 10%, and eventually to around 5%. At this point, it will make no material difference to the end application.

The added weight does translate into a slight increase in size. In a two-wheeler application, we took a standard Ather vehicle, removed the existing motor, and fitted our motor in its place. There’s no noticeable difference in performance. We’ve demonstrated this to the Ather team as well. In this case, our motor was only about 6 mm longer compared to roughly 140 mm overall length. Otherwise, it fits well. In most applications, our motors are effectively drop-in replacements. We haven’t encountered any case where we were rejected due to size or weight constraints.

Established OEMs already have manufacturing lines, processes, and specifications in place. Does that become a roadblock for a new company like Chara?

Yes, absolutely. We currently have around 75 customers who have signed up with us. Initially, most of them place small orders of three to five motors for testing and homologation. Some customers have already moved into serious production, placing orders for 500 to 1,000 motors. Our customer list includes companies such as VST, Greaves, and Sonalika.

However, when it comes to large OEMs like TVS, Mahindra, or Bajaj, there is still some reluctance to adopt reluctance motors because this is a new technology. The motor and controller are the heart of the vehicle, and any failure can have serious consequences. That naturally makes OEMs cautious. The second challenge is startup risk. Large OEMs are hesitant to rely on a critical component from a startup. The third factor is the lack of long-term reliability and safety data, which takes time to build. That said, this is largely a matter of time. We believe that within the next six months, we will onboard at least one large OEM, which would be a significant milestone for us.

Most of your current customers are from agricultural or industrial applications. Is that a fair assessment?

About 50% of our revenue comes from non-highway or off-highway applications—such as agricultural, industrial, and on-campus vehicles. The remaining 50% comes from on-highway vehicles. One of our 3W customers has already completed homologation and is now moving into production. Two other large 3W customers are scheduled to complete homologation this month (Dec 2025). 2W homologation will likely happen in 2026.

How soon can we expect to see a Chara-powered 3W on Indian roads?

One of our customers based in Jalandhar has already completed homologation and is ready to move into production. Typically, the transition from homologation to on-road deployment takes about a quarter, covering manufacturing and sales. Moonrider (e-tractors) has been homologated, and VST has also completed homologation. Bullwork Mobility has deployed our motors in its loaders, and some are already operating in customer fields. They’ve also showcased their large tractor.

I think starting next quarter—or shortly after, depending on customer timelines—you’ll see a flurry of vehicle launches with our motors on public roads.

How does controller integration impact overall motor performance?

The most critical aspect of a reluctance motor is its controllability due to its inherent nonlinearity. We’ve addressed this using advanced algorithms that reside in our controller. That’s why our motor and controller are designed to work together and must be supplied as a combined system. Our core IP sits in the controller—specifically in the software algorithms. Today, we can’t sell just the reluctance motor on its own because there isn’t a standalone reluctance motor controller available in the market yet. The motor and controller have to be purchased together.

Many customers actually prefer this integrated approach because there’s a single point of responsibility. In the current industry model, OEMs often source motors from one supplier and controllers from another—whether it’s SEG, Dana, or other motor suppliers, paired with controllers from companies like Curtis, Sterling Gtake or others—and then integrate them. We believe that this kind of integration is rarely optimal. With our tightly integrated motor–controller system, the pairing is engineered to be optimal from the start. That said, there has been one large customer we’re speaking with who prefers to continue using their in-house controller, as they’ve invested heavily in it. In such cases, we’ve been clear that we can’t support this. Fortunately, more than 90% of our customers value and prefer receiving the motor and controller as a complete, integrated solution.

You recently announced raising ₹52 crore in your Series A round. What are your plans for deploying this capital?

We’ve spent the last six years developing the core technology and products, setting up and tooling our factory, and getting ready for manufacturing—we’re now in production. Going forward, most of our focus will be on business development, sales, and deployment. We’ve invested significant time and effort in R&D, and now it’s important to demonstrate revenue and, eventually, profitability. That said, we will continue to invest in R&D. We are actively developing new products. Today, our largest motor is a 30 kW unit operating at 400 volts, and we’re already planning a 45 kW motor.

Please tell us about your current manufacturing setup.

We’re a Bangalore-based company. Our R&D and testing centre is in HSR, and our manufacturing facility is located in Peenya. Currently, it has the capacity to manufacture around 2,000 motors per month, or roughly 25,000 motors annually.

Within the next 12 to 18 months, we plan to scale up to our next facility, which will support production of about 100,000 motors per year.

Looking five to ten years ahead, do you see rare-earth-free motors remaining a niche solution for specific applications, or do you see a real path to displacing PMSMs as the dominant motor technology across the EV industry?

t’s hard to predict, but I don’t see this as a complete displacement. No single motor technology can solve every application. For applications requiring very high speed, performance, and power density, PMSMs will be difficult to beat. However, most applications simply need a reliable, efficient, and good-quality motor. That’s where technologies like reluctance motors and externally excited synchronous motors come in, and I believe they will co-exist alongside PMSMs.

This represents a significantly large global opportunity. Today, the overall motor market across all applications is around USD 160 billion, with traction motors accounting for a substantial share (around USD 45 billion). In India, the motor market is roughly USD 1 billion. By the end of the decade, the global market could reach around USD 75 billion, of which we believe USD 20–30 billion could be for rare-earth-free motors.

There is also growing research into hybrid approaches, such as using light rare-earth magnets instead of heavy rare earths, rather than eliminating magnets altogether. So, I expect a plurality of approaches, with different technologies serving different applications.

Are there other companies worldwide working on similar magnet-free motors? If so, how does their approach compare with Chara?

Yes, there are several well-funded companies globally working on magnet-free or rare-earth-reduced motor technologies. In the US, there are a few players. Turntide, for example, was working on switched reluctance motors earlier, but they’ve since pivoted away from that. Among startups, there’s Conifer, which is doing something somewhat similar to us, though I don’t have full details. There’s also Olektra, which I believe is working on externally excited synchronous motors. In Europe, there’s Advanced Electric Machines, whose approach we believe is quite similar to ours.

Broadly, the industry seems to be converging on synchronous reluctance motors with some form of magnet assistance. This architecture will be relevant for at least the next decade. In India as well, large companies are beginning to engage. Players like Sona Comstar have announced initiatives in this space, and increased competition is actually positive for us.

Earlier, people used to ask why we were the only company in India doing this, which can be a concern for customers who prefer multiple vendors. With more players entering the space, reluctance motors are increasingly seen as a viable technology. A more distributed vendor and customer base is healthier for the industry as a whole.

Could you give us a sense of your current revenue and production scale?

Last year, we shipped a couple of hundred motors and generated ~₹2.7 crore in revenue. This year, with the factory fully tooled and operational, we’re producing a few hundred motors per month and ramping up toward our capacity of 2,000 motors per month. For this year, we’re projecting booked revenue—based on confirmed purchase orders—of around ₹45 crore. We expect to realise a significant portion of that, with shipped revenue of about ₹20 crore. In volume terms, that translates to roughly 2,000 motors shipped and around 5,000 motors on order.

This interview was first published in EVreporter Jan 2026 magazine.

Also read: Chara Technologies secures ₹52 crore Series A funding to expand rare-earth-free motor production

Subscribe & Stay Informed

Subscribe today for free and stay on top of latest developments in EV domain.