India ICE vs EV sales | For top 2W, 3W, 4W OEMs in January 2026

In January 2026, the overall penetration of EVs in the 2W market was 6.6%. For passenger 3W L5 autos, it was 34.1%, and for cargo 3W L5 autos, it was 22% and for 4W, it was 3.6%. This article aims to showcase where EV sales stand compared to the overall vehicle sales in the 2W, 3W, and 4W categories.

Also Read: Overall EV sales in January 2026

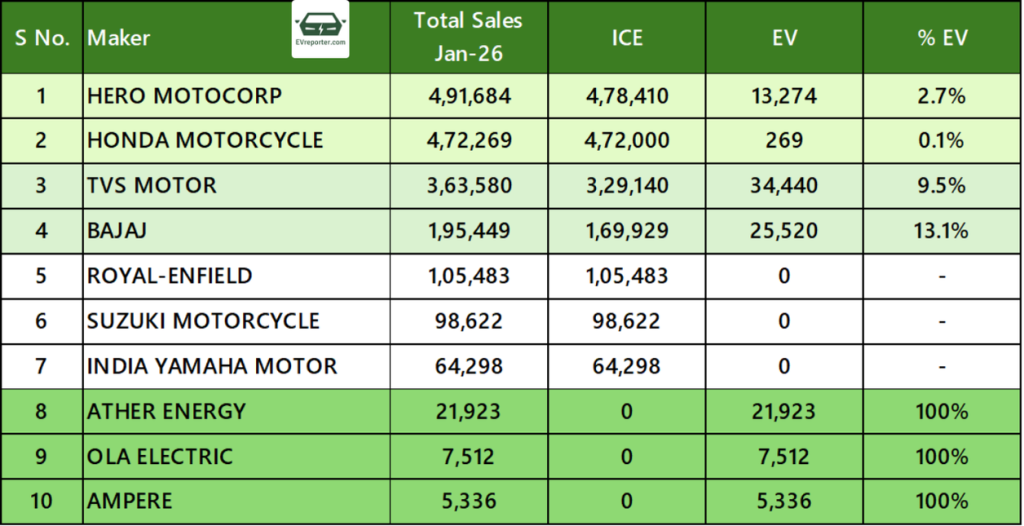

Top Indian OEMs – 2W Sales | ICE vs EV, Jan 2026

Source: Vahan Dashboard as of Feb 2, 2026. Telangana Data not included.

In January 2026, India’s two-wheeler market remained largely ICE-driven, with Hero MotoCorp leading total sales at 4,91,684 units but only 2.7% EV share (13,274 units), followed by Honda at 4,72,269 units with just 269 EVs (0.1%). TVS Motor (3,63,580) and Bajaj Auto (1,95,449) showed stronger EV adoption with 34,440 EVs (9.5%) and 25,520 EVs (13.1%), respectively, while Royal Enfield (1,05,483), Suzuki (98,622) and Yamaha (64,298) reported zero EV sales. Among pure EV players, Ather (21,923) led, followed by Ola Electric (7,512) and Ampere (5,336), all with 100% EV sales.

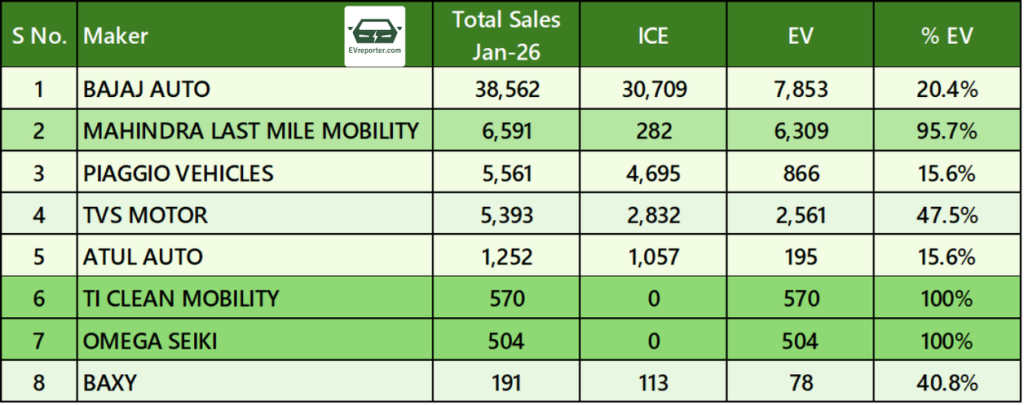

India’s Leading OEMs for Passenger Auto Sales | Jan 2026

Source: Vahan Dashboard as of Feb 2, 2026. Telangana Data not included. Data as per 1402 out of 1462 RTOs across 35 out of 36 state/UTs

In January 2026, Bajaj Auto led India’s passenger three-wheeler market with 38,562 units, with EVs contributing 7,853 units (20.4%). Mahindra Last Mile Mobility recorded 6,591 units with a strong 95.7% EV share (6,309 units), while Piaggio Vehicles (5,561 units) and Atul Auto (1,252 units) posted a modest 15.6% EV mix each. TVS Motor reported 5,393 units, with EVs accounting for 2,561 units (47.5%). Among smaller players, TI Clean Mobility (570) and Omega Seiki (504) achieved 100% EV sales, while Baxy sold 191 units with 40.8% coming from EVs.

India’s Leading OEMs for Goods L5 3W Sales | Jan 2026

Source: Vahan Dashboard as of Feb 2, 2026. Telangana Data not included.

In January 2026, Bajaj Auto led India’s L5 cargo three-wheeler market with 6,225 units, with EVs contributing 465 units (7.5%). Piaggio Vehicles sold 2,973 units with a low 2% EV share (60 units), while Atul Auto recorded 1,814 units with a relatively higher 15.9% EV mix (289 units). Mahindra Last Mile Mobility posted 927 units, with EVs accounting for 471 units (50.8%), the highest EV share among major OEMs. Among pure EV players, Omega Seiki (370), Euler Motors (217) and Green Evolve (140) reported 100% electric sales, while Baxy remained largely ICE-led with 133 units and just 6 EVs (4.5%).

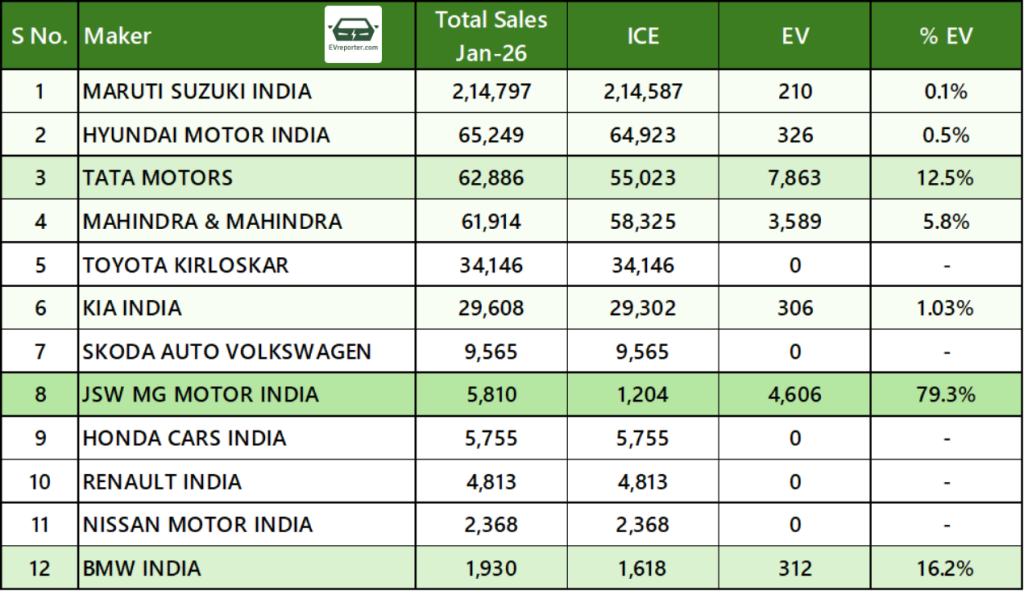

Leading Passenger Vehicle OEMs | ICE vs EV, Jan 2026

Source: Vahan Dashboard as of Feb 2, 2026. Telangana Data not included. Data as per 1402 out of 1462 RTOs across 35 out of 36 state/UTs

In January 2026, India’s passenger vehicle market was led by Maruti Suzuki with 2,14,797 units, but with a negligible EV share of 0.1% (210 units). Hyundai followed with 65,249 units and 0.5% EV penetration (326 units), while Tata Motors showed the strongest EV volumes among major OEMs with 7,863 EVs out of 62,886 units (12.5%). Mahindra & Mahindra recorded 61,914 units, with EVs contributing 3,589 units (5.8%). JSW MG Motor India stood out with the highest EV share at 79.3% (4,606 EVs out of 5,810 units), while Kia reported a limited EV mix of 1.03% (306 units). In contrast, Toyota Kirloskar, Skoda Auto Volkswagen, Honda Cars, Renault, and Nissan remained ICE-only, while BMW India posted 1,930 units with 312 EVs (16.2%), indicating growing EV adoption in the luxury segment.

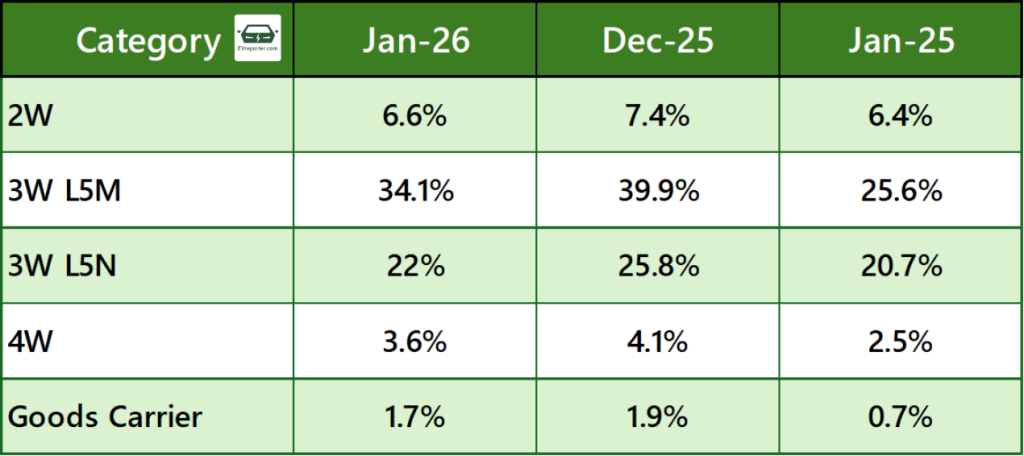

Category wise EV Penetration, Jan 2026

Source: Vahan Dashboard. Data as per 1402 out of 1462 RTOs across 35 out of 36 state/UTs

In January 2026, EV penetration stood at 6.6% in the 2W segment (down from 7.4% in Dec-25, but slightly higher than 6.4% in Jan-25). 3W L5M (passenger) recorded the highest EV share at 34.1% (lower than 39.9% in Dec-25, but up from 25.6% a year ago), while 3W L5N (cargo) reached 22% (down from 25.8% in Dec-25, and marginally above 20.7% in Jan-25). In 4W, EV share was 3.6% (vs 4.1% in Dec-25 and 2.5% in Jan-25), and goods carriers stood at 1.7% (slightly down from 1.9% in Dec-25, but higher than 0.7% last year).

For deeper insights into India’s EV sales trends (including Telangana data) – Segment-wise, OEM-wise, city-wise, RTO-wise and state-wise – check out the EVreporter Data Portal here and subscribe.

Also read: India ICE vs EV sales | For top 2W, 3W, 4W OEMs in December 2025

Subscribe & Stay Informed

Subscribe today for free and stay on top of latest developments in EV domain.