India ICE vs EV sales | For top 2W, 3W, 4W OEMs in September 2025

In September 2025, the overall penetration of EVs in the 2W market was 8.1%. For passenger 3W L5 autos, it was 37.8%, and for cargo 3W L5 autos, it was 25.5% and for 4W, it was 5.1%. This article aims to showcase where EV sales stand compared to the overall vehicle sales in the 2W, 3W, and 4W categories.

Also Read: Overall EV sales in September 2025

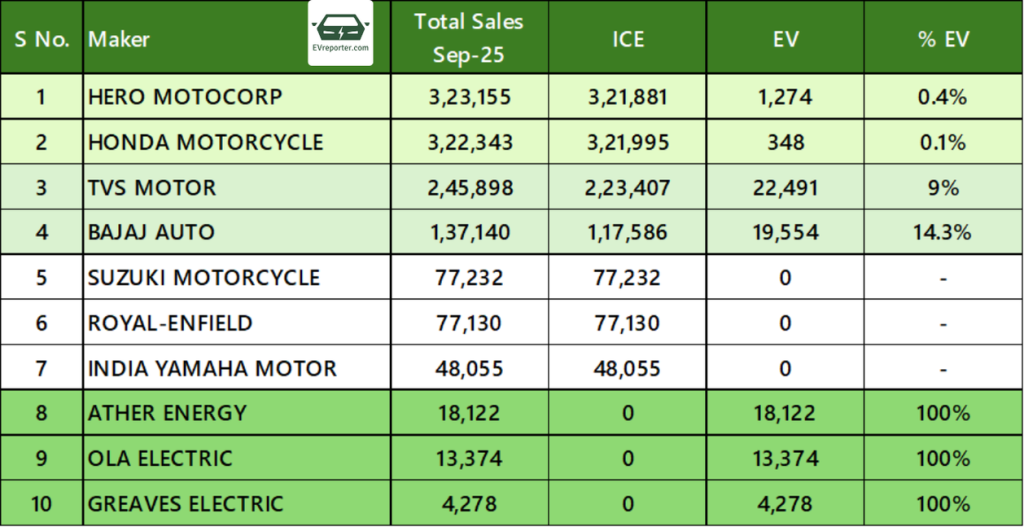

OEM wise Leading 2W Sales for ICE and EV, Sep 2025

In September 2025, the two-wheeler market recorded strong sales with a mix of ICE and EV contributions. Hero MotoCorp (3,23,155 units) and Honda Motorcycle (3,22,343 units) led in overall volumes but had negligible EV share at 0.4% and 0.1%, respectively. TVS Motor sold 2,45,898 units, with EVs making up 9% (22,491 units), while Bajaj Auto achieved the highest EV penetration among legacy players at 14.3% (19,554 of 1,37,140 units). Suzuki, Royal Enfield, and Yamaha remained fully ICE-dependent. Among pure EV makers, Ather Energy (18,122), Ola Electric (13,374), and Greaves Electric (4,278) recorded 100% EV sales.

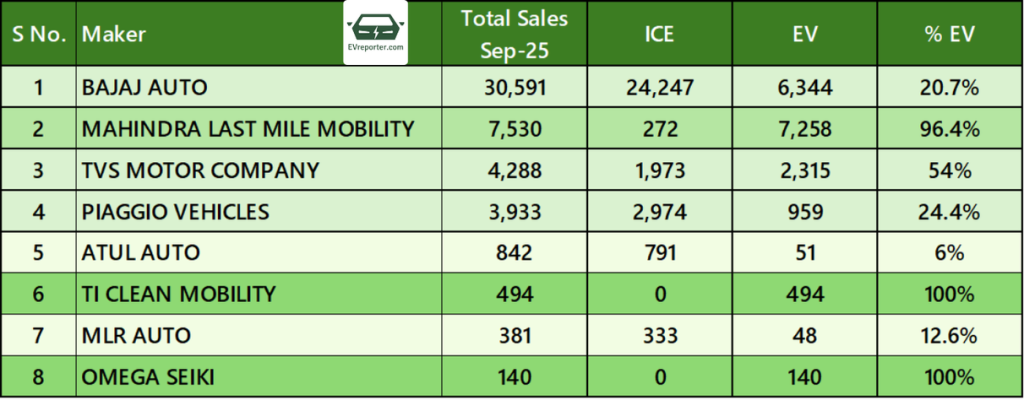

OEM wise Leading 3W L5 Pax Sales for ICE and EV, Sep 2025

Source: Vahan Dashboard as of Oct 2, 2025. Telangana Data not included. Data as per 1392 out of 1458 RTOs across 35 out of 36 state/UTs

In September 2025, Bajaj Auto led the three-wheeler passenger market with 30,591 units, of which 20.7% (6,344) were EVs. Mahindra Last Mile Mobility followed with 7,530 units, showing a strong 96.4% EV share. TVS Motor sold 4,288 units, with over half (54%) being electric, while Piaggio Vehicles posted 24.4% EV penetration (959 of 3,933 units). Atul Auto (6%) and MLR Auto (12.6%) had modest EV contributions. TI Clean Mobility (494) and Omega Seiki (140) recorded 100% EV sales, underlining their pure-electric focus.

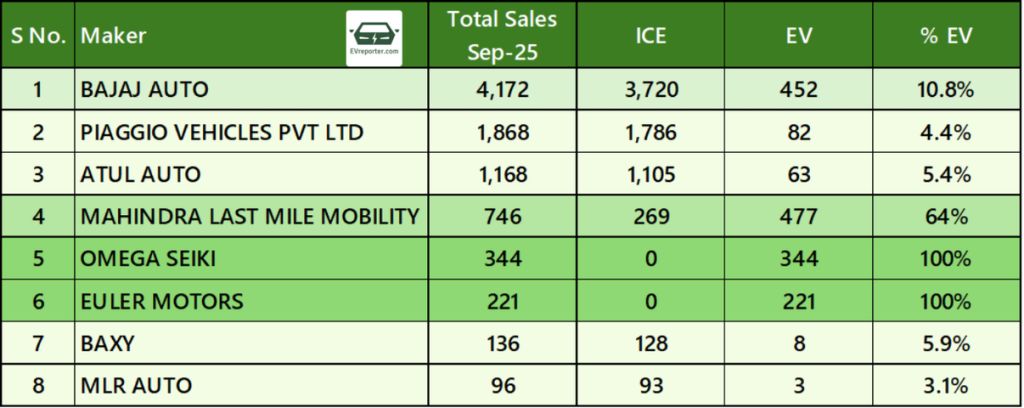

OEM wise Leading 3W L5 Goods Sales for ICE and EV, Sep 2025

In September 2025, Bajaj Auto led the L5 cargo three-wheeler market with 4,172 units, of which 10.8% were electric. Mahindra Last Mile Mobility stood out with a 64% EV share (477 of 746 units), while Piaggio (4.4 %), Atul Auto (5.4%), Baxy (5.9%) and MLR Auto (3.1%) showed only modest electrification. Meanwhile, Omega Seiki (344 units) and Euler Motors (221 units) sold 100% EVs, underscoring their full commitment to electric three-wheelers.

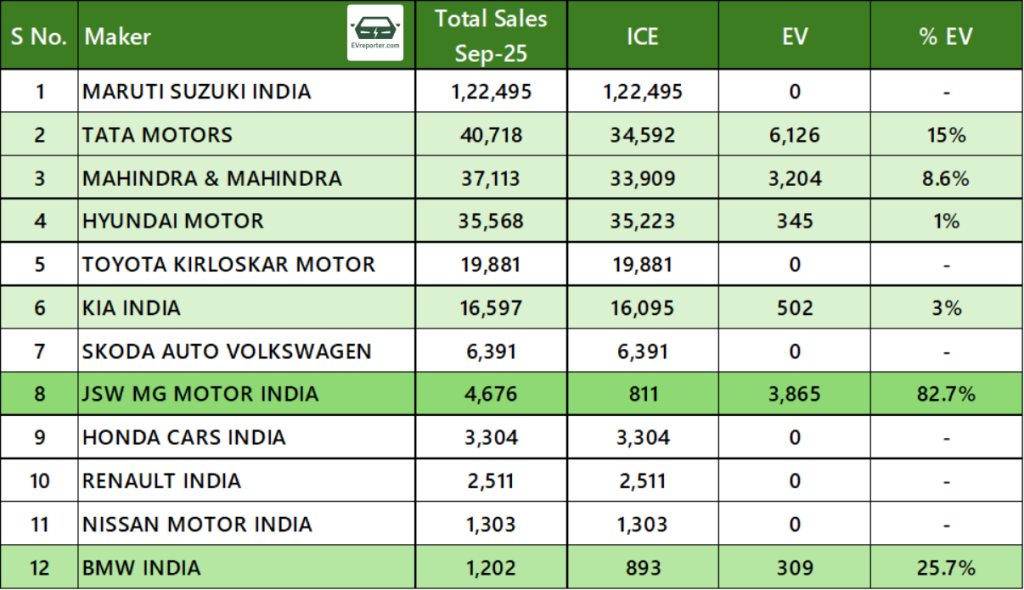

OEM wise Leading 4W Sales for ICE and EV, Sep 2025

Source: Vahan Dashboard as of Oct 2, 2025. Telangana Data not included. Data as per 1392 out of 1458 RTOs across 35 out of 36 state/UTs

In September 2025, Maruti Suzuki dominated India’s 4W market with 1,22,495 units but had no EV sales. Tata Motors followed with 40,718 units, of which 15% were EVs, while Mahindra & Mahindra sold 37,113 units with 8.6% EV penetration. JSW MG Motor India stood out with the highest EV share at 82.7% (3,865 of 4,676 units), and BMW India also showed strong electrification with 25.7% EV sales. Hyundai (1%) and Kia (3%) had limited EV adoption, while Toyota, Skoda, Honda, Renault, and Nissan remained fully ICE-focused.

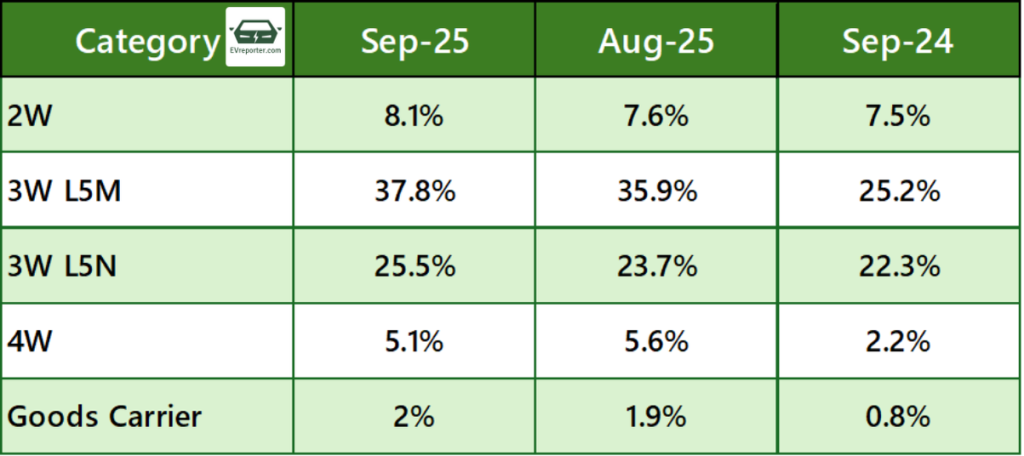

Category wise EV Penetration, Sep 2025

Source: Vahan Dashboard. Data as per 1392 out of 1458 RTOs across 35 out of 36 state/UTs

In September 2025, EVs accounted for 8.1% of 2W sales (up from 7.6% in August and 7.5% last year). EV share in 3W passenger (L5M) rose to 37.8% (from 35.9% in August and 25.2% last year), while 3W cargo (L5N) climbed to 25.5% (vs 23.7% in August and 22.3% last year). For 4Ws, EV penetration stood at 5.1% (slightly down from 5.6% in August but well above 2.2% last year), and goods carriers reached 2% (up from 1.9% in August and 0.8% a year ago).

For deeper insights into India’s EV sales trends (including Telangana data) – Segment-wise, OEM-wise, city-wise, RTO-wise and state-wise – check out the EVreporter Data Portal here and subscribe.

Also read: India ICE vs EV sales | For top 2W, 3W, 4W OEMs in August 2025

Subscribe today for free and stay on top of latest developments in EV domain.