Lithium-ion battery recycling in India – Need to build local refining capabilities to curb black mass export

In the era of technological advancement, batteries power our lives, from smartphones to electric vehicles. However, the rapid growth of this industry has given rise to a pressing concern—what happens to these batteries at the end of their lifecycle? In India, the battery recycling sector stands at a crossroads, presenting both challenges and untapped opportunities. In this opinion piece, battery recycling practitioner Rahul Jha shares his take on the current scenario and the need to build material recovery capabilities within the country.

Current Scenario

India, like many other nations, faces the mounting issue of battery disposal. The current landscape reveals a burgeoning sector with a mix of formal and informal players striving to manage the increasing volume of discarded batteries. Currently, China is at the helm of the global recycling ecosystem and the global strategic metals, rare earth metals, and precious metals stockpile. They control the global pricing of all commodities as of now. They will continue to do so till the entire recycling industry succumbs to the predatory pricing methods adopted by China due to the sheer volume and scale at which they are working.

Challenges

Informal Recycling Practices

The informal sector, operating without regulations, poses environmental and health risks. Unregulated disposal methods lead to soil and water pollution, while workers in these facilities face hazardous conditions.

Lack of Awareness

A lack of awareness among consumers about proper battery disposal exacerbates the problem. Many are unaware of the environmental impact and potential harm caused by improper disposal methods.

Lack of Offtake for Recycled Materials

Despite recycling efforts, a significant hurdle lies in the struggle to find markets and buyers for recycled materials in India compared to China. Industries are driven by concerns about material quality and reliability and remain hesitant to adopt recycled components.

Discouraging Partial Recycling and Export of Unrefined Material

India should demotivate partial recyclers and put an immediate halt to the export of unrefined materials because if we encourage them, we are at an absolute loss as we would be losing in on our critical metals (Cobalt, Lithium, Nickel, Manganese, and Copper) stockpile. By focusing on refining processes domestically, India can build its strategic material stockpile, ensuring a more sustainable and self-reliant approach.

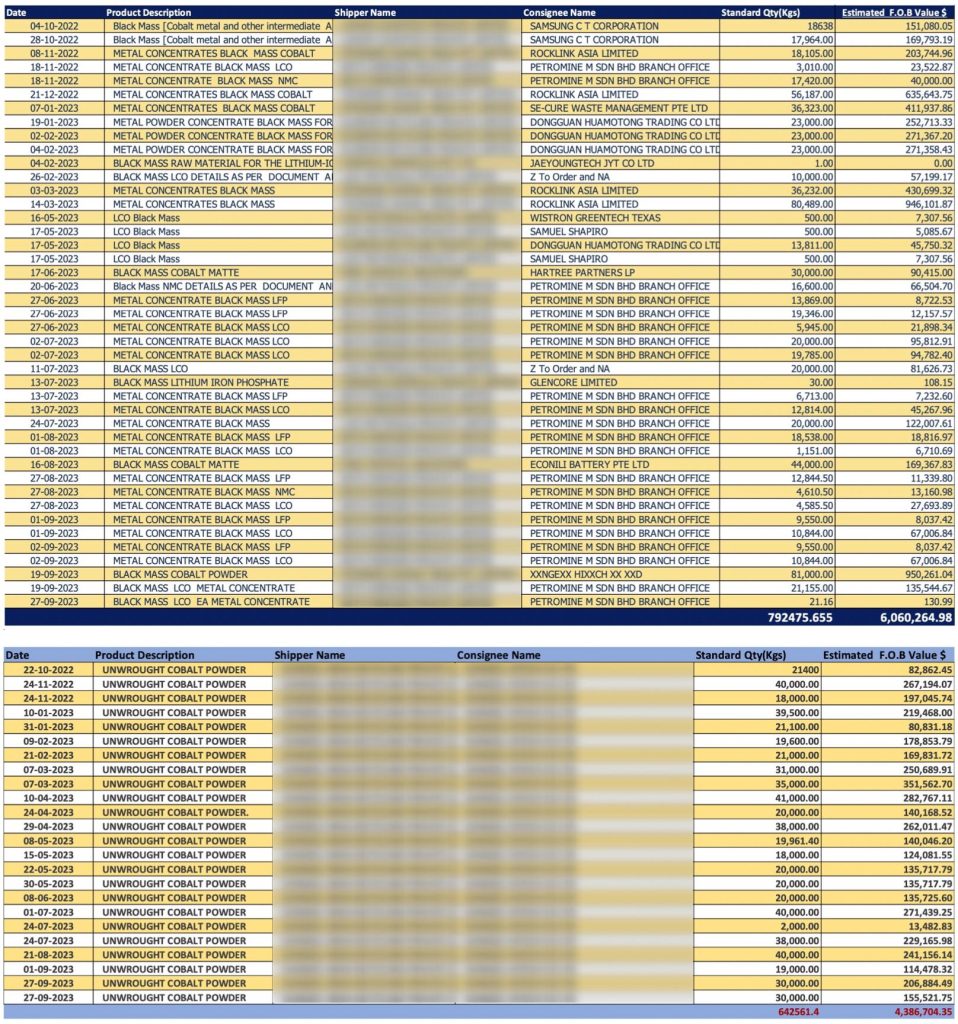

Black Mass/ Unwrought Cobalt Powder/mixed metal powder is the product that all the recyclers have managed to produce. This is merely a fraction of recycling that recyclers do, and to gain a quick buck, they ship the same to wide-ranging countries such as South Korea, the Philippines, China & Indonesia. Some conglomerates have set up their entities in India and have been shipping this to the above-mentioned countries and are stockpiling the same currently (Hedging). This has led to increased prices of raw materials, i.e., Spent Lithium-ion batteries for actual refiners who are on the verge of pausing all refining activities due to such increased pricing of the un-refined product.

To explain this, I can say that the price of Black Mass is much higher than the price of Cobalt Sulphate (a finished good obtained from refining Black Mass, which is in the majority content and a part of precursor material to be used in the manufacturing of Lithium-ion Batteries). Global players deliberately do this to discourage final refining/recycling in India and keep a hold on all metals by spiking the price of unfinished goods.

Opportunities

Government Initiatives

The Indian government can potentially play a pivotal role in steering the battery recycling sector towards sustainability. Policies and incentives could be devised to promote responsible disposal and recycling practices. The government can also step in and create a national reserve for critical metals, which would ensure the offtake of all recycled materials to the government, as China has done.

Technological Advancements

Embracing innovative recycling technologies, such as hydrometallurgical processes and advanced sorting systems, can enhance efficiency and reduce the environmental footprint of recycling facilities.

Promoting Circular Economy Practices

Encouraging industries to incorporate recycled materials into their manufacturing processes is vital. Establishing a circular economy approach can not only benefit the environment but also create a market for recycled materials. The government, in its recent push to promote a circular economy, launched the EPR mechanism, which mainly focuses on producers of electronic manufacturing companies being given targets for the collection, disposal, and recycling of end-of-life products through the EPR credit mechanism which is to be generated by the recyclers. The government could have inserted the clause of using the same recycled products in manufacturing, which could have further boosted this entire mechanism.

In the current scenario, it is easy for recyclers to get away by generating invoices of semi-finished goods or, in fact, can generate invoices of finished goods to dummy entities to generate EPR Credits, which will later on be bought by producers on the government-launched EPR Portal.

Case Studies

Several success stories globally provide inspiration for India’s battery recycling sector. Notably, China’s & South Korea’s pioneering efforts in battery recycling highlight the effectiveness of a well-structured and supported recycling industry. Comparing India’s battery recycling sector with China’s practices sheds light on potential strategies for improvement. China’s robust recycling infrastructure and the exceptional offtake of recycled materials could be a model for India’s development.

Environmental Impact

Proper battery recycling is not just a matter of waste management; it’s an environmental imperative. It reduces resource depletion, prevents pollution, and minimizes greenhouse gas emissions, contributing to a more sustainable future.

Future Outlook

As electric vehicles and renewable energy storage become increasingly prevalent, the demand for efficient battery recycling is poised to surge. Addressing the lack of offtake for recycled materials becomes crucial in ensuring the sector’s growth and sustainability.

Conclusion

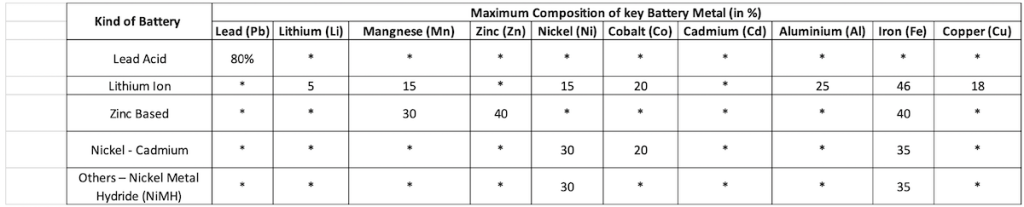

Black mass export data obtained through third-party sources show that we are losing a significant amount of critical metals on a year-on-year basis. Let’s take the average value of metal content as described by our national pollution monitoring agency, i.e., CPCB, on their newly launched portal, as shown in Figure 1 above. We can deduce that we have lost 350 Tonnes of Cobalt Metal, 71.7 Tonnes of Lithium Metal, and 215 Tonnes of Nickel metal this year alone. The volume may be much more as the data is partial, and some recyclers have not been covered. These figures should serve as a wake-up call for the Indian government. Currently, India has yet to capitalize on its recently discovered lithium mines, a resource that is notably absent in terms of cobalt and nickel. This highlights an opportunity for the government to strategically focus on developing its refining/recycling sector, which is already established and has the potential to reshape India’s global standing.

India’s battery recycling sector stands on the cusp of transformation. By learning from China’s success, addressing challenges, capitalizing on opportunities, discouraging partial recyclers, and fostering demand for recycled materials, we can pave the way for a more sustainable and circular approach, unlocking the true potential of this critical industry.

About the author

Rahul Jha works with ADV Metal Combine Pvt. Ltd. ADV Metal Combine Pvt. Ltd. was incorporated in 1997 and has since then engaged in the waste recycling business. Their LIB and E-waste recycling division in Bhilai, Chhatisgarh became functional in 2008 by jointly developing technologies with CSIR-NML Jamshedpur and, later on, BARC. ADV has a fully functional LIB recycling facility in which they produce battery-grade raw materials such as Cobalt Sulphate, Lithium Carbonate, Nickel Sulphate, Copper Sulphate and Manganese Sulphate, which all are essentially required for LIB manufacturing. Currently, the company is operating with a capacity of refining 2MT/Day (Black Mass) and has planned to scale it up to 8MT/day by August 2024.

Subscribe & Stay Informed

Subscribe today for free and stay on top of latest developments in EV domain.

Pingback: Building large scale hydrometallurgy operations to extract battery materials | Chat with Bhuwan Purohit - Rubamin • EVreporter