India’s electric vehicle supply chain landscape | An overview

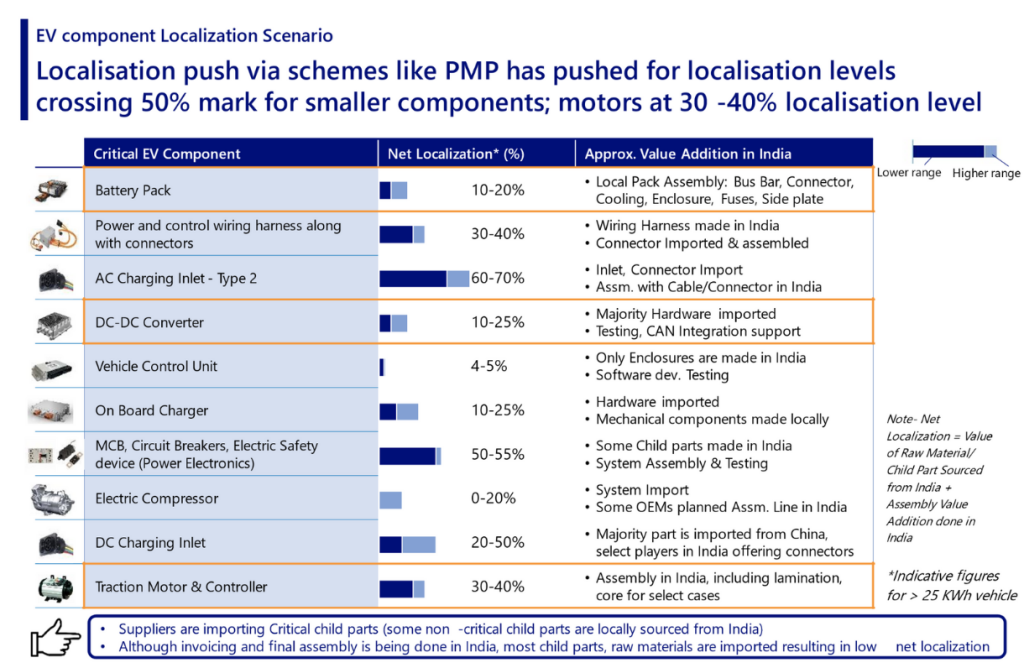

As of 2024, localization levels for critical electric vehicle components such as motors and controllers remain at 30-40% in India, reflecting a significant gap, writes Preetesh Singh, Manager – CASE and Alternative Powertrains at Nomura Research Institute (NRI) in his analysis of India’s electric drivetrain supply chain.

EV Manufacturing and Assembling

There is significant EV push from Indian government’s policy initiatives, such as the FAME scheme and the new PM E-Drive with a total outlay of INR 10,900 crore, including INR 2,000 crore specifically for charging infrastructure. These policies, coupled with attractive tax and incentive benefits, like PLI scheme or Basic Customs Duty (BCD) on imported components such as motors, aim to increase localization, making the supply chain for critical child parts mature & robust.

The current state of EV manufacturing in India is categorized into four strategies: SKD Imports, CKD Imports, Buying Critical Components with Assembly in India and Component Child Part Imports with Sourcing & Assembly in India.

The reliance on imports, particularly for critical components such as motors and controllers, is evident across all these strategies. While some OEMs & suppliers have started localizing manufacturing, dependence on foreign suppliers for raw materials and critical child parts continues to pose challenges.

Localisation Status of EV Components

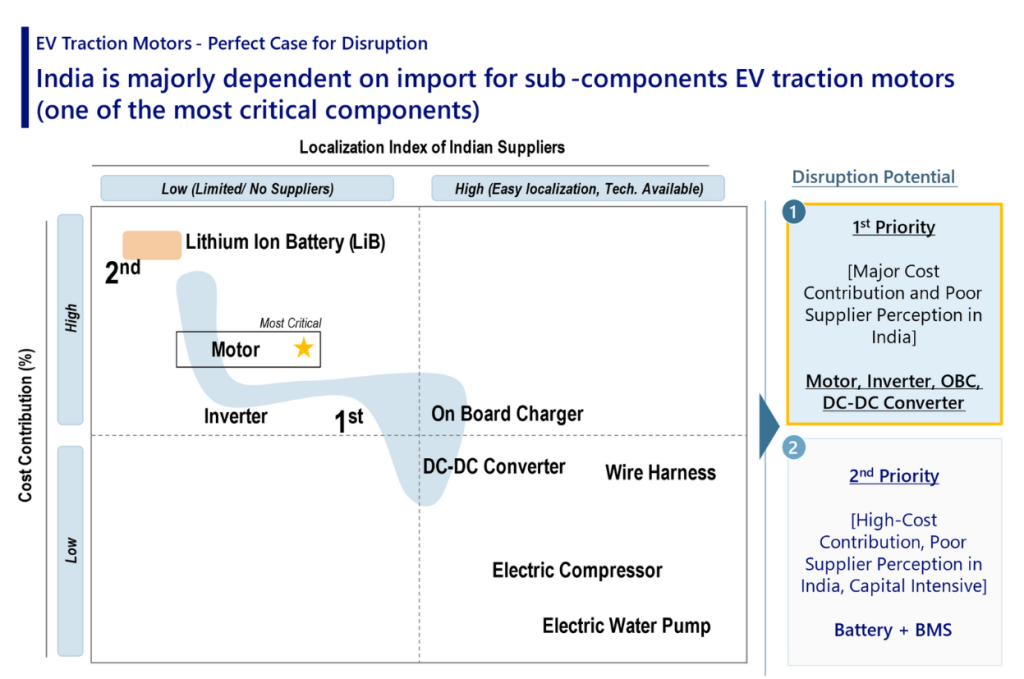

Localization of EV components is vital for several reasons like cost reduction, supply chain resilience, and long-term sustainability. The government is pushing for localization, but it remains challenging today. Localization of the following three critical EV components is necessary:

Motors and Controllers

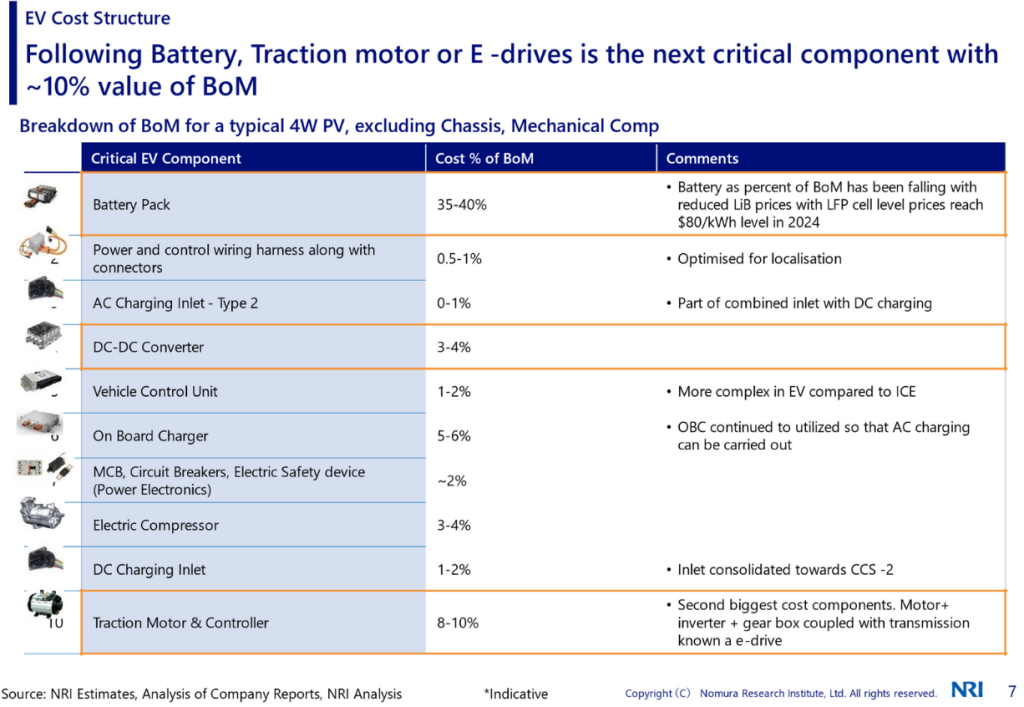

They together form the e-drive, the second-largest cost component of an EV, accounting for 8-10% of the BoM. Localization of these components remains a challenge, with only 30-40% of the motor being localized. Most of the critical child parts, such as the rotor, stator, and permanent magnets, are imported.

Source: Nomura Research Institute

Source: Nomura Research Institute

Localisation status of EV components

EVs utilize various types of motors, each offering distinct benefits. In India, Brushless Direct Current (BLDC) and Permanent Magnet Synchronous Motors (PMSM) are the most common choices across different EV segments due to their balance of performance and cost.

Brushless Direct Current Motor (BLDC):

A BLDC motor delivers current through a commutator into coils on the rotor, with the rotor itself being a permanent magnet. The coils, however, remain fixed on the stator. This configuration allows BLDC motors to offer a balanced mix of efficiency & cost-effectiveness.

It is used by Ola, Ampere, TVS and Ather for their e-2Ws and also by YC Yatri e-rickshaw.

Permanent Magnet Synchronous Motor:

PMSM motors are a type of AC synchronous motor where the field is excited by permanent magnets with its rotor generating a magnetic field. It is highly efficient, making it ideal for high performance vehicles. However, it is expensive due to the use of permanent magnets.

Commonly used in cars and buses e.g. Tata Urban E-bus, Mahindra XUV400 EV, MG ZS EV, Hyundai Ioniq 5, etc.

Induction Motor (IM):

These are asynchronous motors where the electric current in the rotor is induced by EM induction from the stator winding’s magnetic field. These motors offer cost advantages. They are not as efficient as PMSM under heavy loads.

These motors are used across vehicle segments, including LCVs & cars like Tata Ace EV, Mahindra Treo 3W, Tesla S & X models, etc.

Switched Reluctance Motor:

Switched Reluctance Motors’ rotor contains no magnets or coils. The motor operates by sequentially energizing the stator windings, creating a magnetic field that pulls the rotor into alignment. It can deliver high torque but struggles with inefficiencies at lower speeds. These are not common in EVs and are emerging for heavier industrial applications.

Range Rover SV comes with SRM motor.

Critical EV Motor Child Parts’ Availability in India

The performance of an EV traction motor, which converts electrical energy into mechanical motion is heavily influenced by several critical child parts, including copper coils, MG (magnetic) cores, stator laminations, permanent magnets (made from rare-earth metals), etc. After understanding how important EV motors are, with an 8-10% of BoM, it becomes crucial to understand the Indian landscape of EV motor child parts suppliers.

Copper Coil in EV Motors

Copper coils are used in the windings of the stator to generate the magnetic fields necessary for motor operation. India is world’s 4th largest copper importer, and also has significant copper reserves in the states of Madhya Pradesh, Rajasthan, and Jharkhand. The copper wire industry is well-developed in India, and while there are no suppliers currently specializing in EV-specific copper coils, many have the capability to do so as demand grows.

MG Core (Magnetic Core)

MG cores, also known as laminated steel cores, are essential for reducing energy losses in EV motors. They consist of thin layers of steel sheets coated with insulating material to minimize eddy currents, which can cause power loss and heat buildup. The thickness of these sheets plays a crucial role in the motor’s efficiency, with thinner laminations offering better performance.

Permanent Magnet

Permanent magnets, particularly those made from rare earth metals like neodymium, are crucial for creating the strong magnetic fields required in high-performance EV motors, especially PMSMs. These magnets significantly influence the motor’s power density, torque, and overall efficiency. India imports 92% of its rare earth metals from China, which controls 79% of the global rare earth metals market.

Due to the reliance on China for rare earth materials, localizing permanent magnet production in India is a major challenge. The high cost of rare earth metals, coupled with the complex processing required, makes localization difficult.

Way Forward for India to Improve EV Localization | Recommendations

- The government’s PLI Auto Component Champion Scheme needs to accelerate certification processes, especially for e-drives, motors, and controllers, to boost domestic manufacturing.

- The development of rare-earth-free motor technologies like Switched Reluctance Motors (SRM) should be prioritized. Promoting technologies like these could safeguard the supply chain against global disruptions and price hikes in rare-earth metals.

- To foster innovation and reduce import dependence, a more robust R&D ecosystem is needed. Upskilling engineers and creating specialized laboratories focused on motor design and electrical testing can enhance the design capabilities of Indian suppliers. Strengthening of industry-academia collaboration via schemes like the Advanced National Research Foundation (ANRF) can accelerate R&D efforts as well.

- As components like inverters and controllers rely heavily on semiconductor chips, India’s semiconductor policy must align with its EV goals. Increased domestic production of semiconductors will boost the localization of motor controllers and other electronic parts, driving down costs and reducing the reliance on imports.

Special thanks to co-authors Athul Nambolan, Deputy Senior Consultant and Som Pathak, Associate Consultant at Nomura Research Institute for their extensive contribution to this analysis.

Also read: Driving toward tomorrow: Insights into EV charging infrastructure development

Subscribe today for free and stay on top of latest developments in EV domain.