India’s Passenger 3W Autos Increasingly Turn Electric | Sales Trend and Analysis

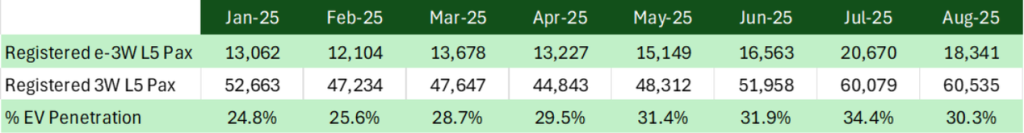

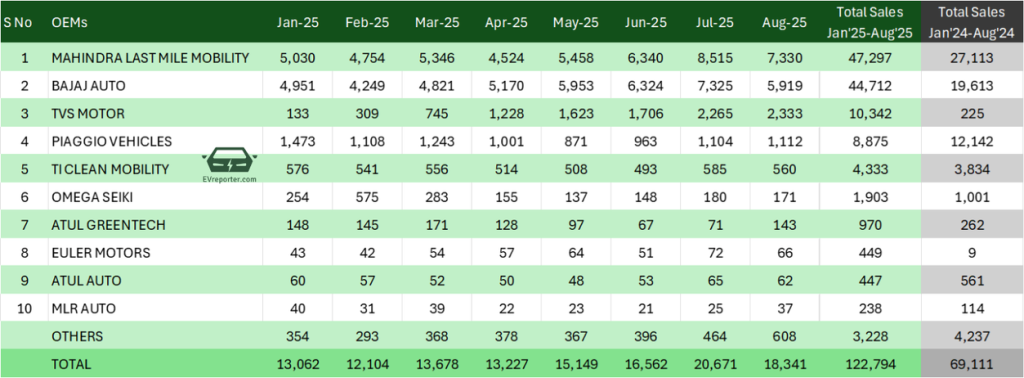

4,13,271 L5 passenger 3Ws (L5M) were registered in India from January 2025 to August 2025, of which 1,22,794 were electric. In comparison, 69,111 e-3W L5 Pax were registered during the period from January 2024 to August 2024. India’s e-3W L5 Pax registration numbers achieved 77.7% YoY growth in sales numbers compared to the previous year.

The average EV penetration in the 3W L5 Pax market was 29.7% as of CY’25 (till August 2025), up from 18.2% in CY’24 (till August 2024).

Mahindra Last Mile Mobility is the top-selling EV OEM in the category, followed by Bajaj Auto. Together, the two hold a combined market share of almost 75%.

This graph displays the EV penetration trend for 3W L5 Pax vehicles.

Intelligence: EVreporter | Data Source: Vahan Dashboard and Telangana Regional Transport portal (Data as on 4th Sept, 2025)

Note: Low-speed E-rickshaws are not considered in the above calculation.

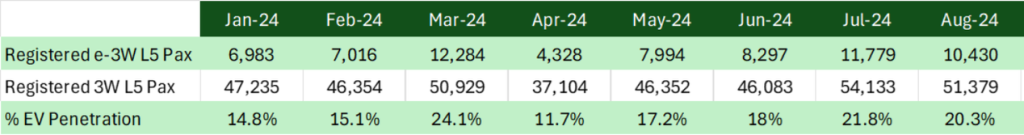

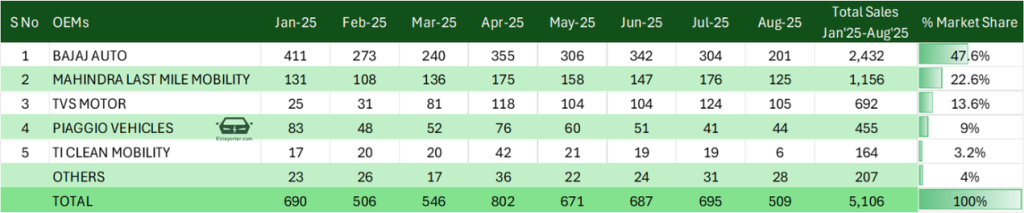

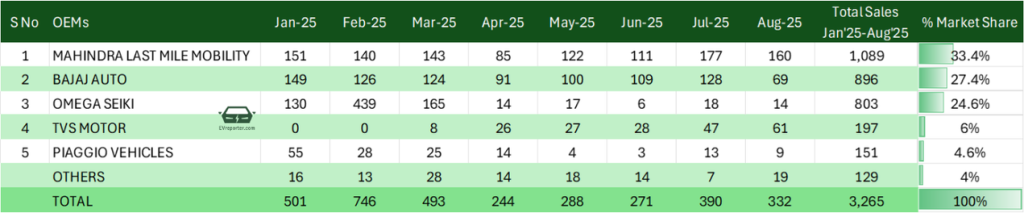

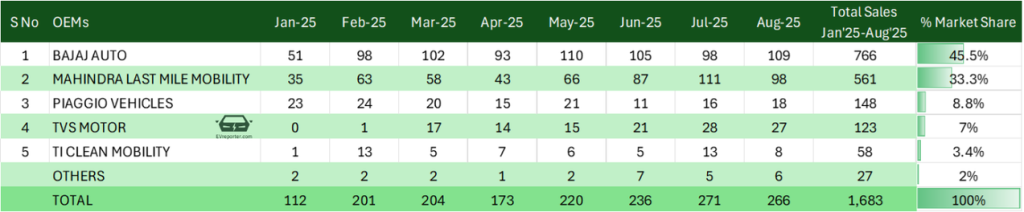

e-3W (L5 Pax) OEM-wise sales, Jan’25-Aug’25 | CY 2025

Intelligence: EVreporter | Data Source: Vahan Dashboard and Telangana Regional Transport portal (Data as on 4th Sept, 2025)

- Mahindra Last Mile Mobility is the top-selling EV OEM in the e-3W L5 passenger category.

- Mahindra Last Mile Mobility and Bajaj Auto are the market leaders in the category, with a combined market share of almost 75% this year.

- The distant third spot is held by TVS Motor, which has seen continuous growth in sales numbers this year.

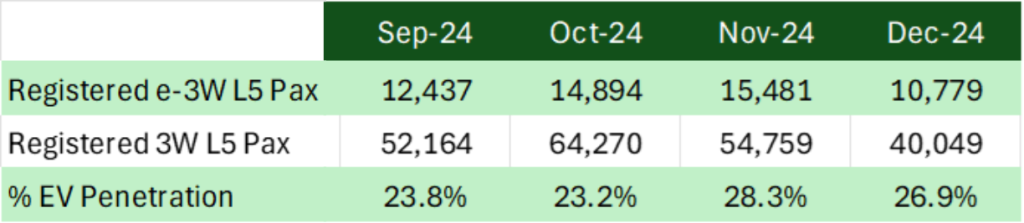

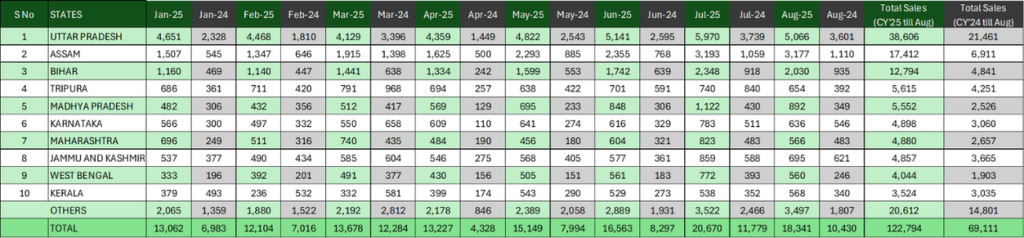

e-3W (L5 Pax) state-wise sales, Jan’25-Aug’25 | CY 2025

Intelligence: EVreporter | Data Source: Vahan Dashboard and Telangana Regional Transport portal (Data as on 4th Sept, 2025)

- In the period of observation, e-3W Passenger L5 vehicles were best-selling in the states of Uttar Pradesh with 38,606 units (31.4% of all e-3W L5 pax vehicles sold in India), followed by Assam with 17,412 units (14.2%) and Bihar with 12,794 units (10.4%).

- The e-3W L5 pax sales is witnessing rapid growth. YoY growth – Meghalaya (519.2%), Manipur (254.9%), Tamil Nadu (168.6%), Bihar (164.3%), Assam (151.9%), Madhya Pradesh (119.8%).

- Bajaj and Mahindra Last Mile Mobility sold 15,397 and 14,113 units, respectively, in UP.

- In Meghalaya, Mahindra Last Mile Mobility dominates the market with an 86.6% share, whereas in Manipur, Bajaj leads with a 52.7% share.

- In the South India region, Bajaj holds a dominant market share of 41.6%, followed by Mahindra Last Mile Mobility at 15.7% and TVS at 15.5%.

- In the West region of India, Bajaj holds a dominant market share of 50.8%, followed by Mahindra Last Mile Mobility at 32.9%.

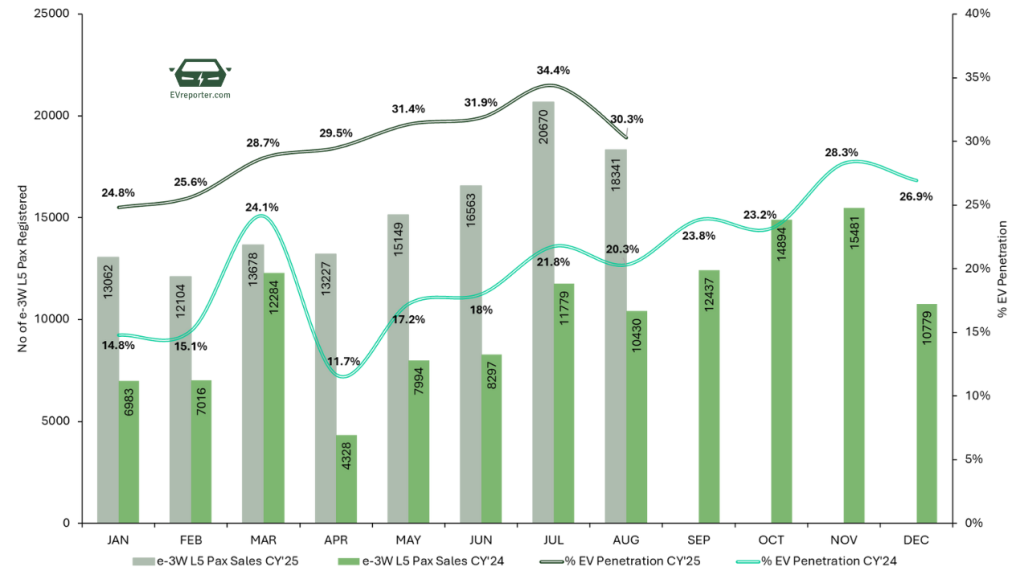

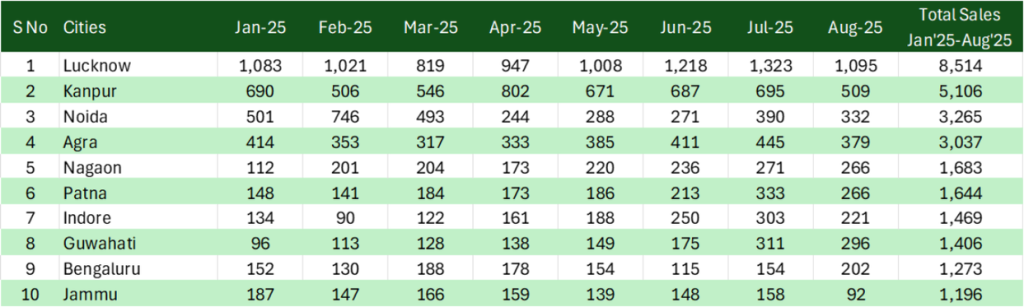

Leading cities for e-3W L5M Sales| Jan’25-Aug’25

Intelligence: EVreporter | Data Source: Vahan Dashboard and Telangana Regional Transport portal (Data as on 4th Sept, 2025)

- Top 3 cities – Lucknow, Kanpur and Noida

- Top 10 cities accounted for nearly 23% of overall e-Auto (pax) sales.

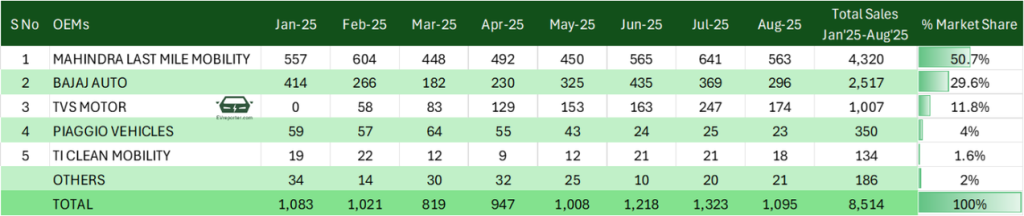

Top OEMs (e-3W L5 Pax) in the 5 leading cities | Jan-Aug 2025

LUCKNOW, UTTAR PRADESH

KANPUR, UTTAR PRADESH

NOIDA, UTTAR PRADESH

AGRA, UTTAR PRADESH

NAGAON, ASSAM

Intelligence: EVreporter | Data Source: Vahan Dashboard and Telangana Regional Transport portal (Data as on 4th Sept, 2025)

Contact us at info@EVreporter.com to receive exclusive custom data reports and analysis at your desired frequency – delivered directly to your mailbox.

For insights into India’s EV sales trends (including Telangana data), including segment-wise, OEM-wise, city-wise, RTO-wise, and state-wise data, check out the EVreporter Data Portal here and subscribe.

Also read: India L5 E-3W sales trend | Jan 2024 – Aug 2024

Subscribe & Stay Informed

Subscribe today for free and stay on top of latest developments in EV domain.