Lithium-ion cell manufacturing and value chain | Current landscape in India

From the inception of the National Electric Mobility Mission Plan 2020, Indian policymakers have been acutely aware of the significance of localizing the EV supply chain. The impetus behind this localization drive encompasses multiple objectives, ranging from cost reduction and the stimulation of indigenous manufacturing to ensuring energy self-sufficiency and championing eco-friendly mobility solutions.

Preetesh Singh (Specialist, CASE and Alternate Powertrains) and Mridul Agarwal (SAC) at Nomura Research Institute present their research and analysis of India’s current landscape of local cell manufacturing and supply chain.

EV batteries

According to Niti Aayog, electric vehicles alone are poised to account for approximately 64% of the cumulative battery potential in India between 2022 and 2030, with grid storage applications following closely behind. Currently, the battery landscape is primarily dominated by LFP and NMC variants. LFP batteries are the preferred choice for E4W, while NMC batteries predominantly power E2Ws. Consequently, it becomes imperative to meticulously scrutinize the localization prospects for these two battery types within the Indian market.

Image by Nomura Research Institute

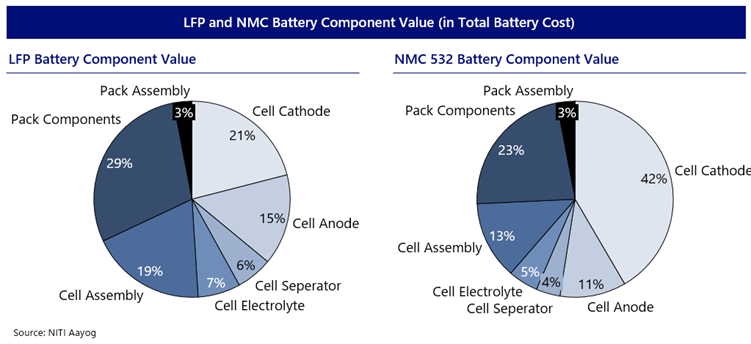

A cost breakdown of these batteries into cell and pack components is done above. Remarkably, the pack components and pack assembly together constitute approximately 30% of the battery component’s overall value. The cell can be further disassembled into Cathode, Anode, Separator and Electrolytes.

Among these, the cell cathode emerges as the primary cost contributor, commanding a significant 21% in LFP batteries and a substantial 42% in NMC batteries.

Yet, the downstream supply chain for these critical components, encompassing cathode, anode, separator, and electrolyte, finds itself in a fledgling state in India. This fragility is primarily attributed to the scarcity of raw materials, a limited number of manufacturers, and the inherent uncertainty regarding demand security.

Source: NITI Aayog; Image by Nomura Research Institute

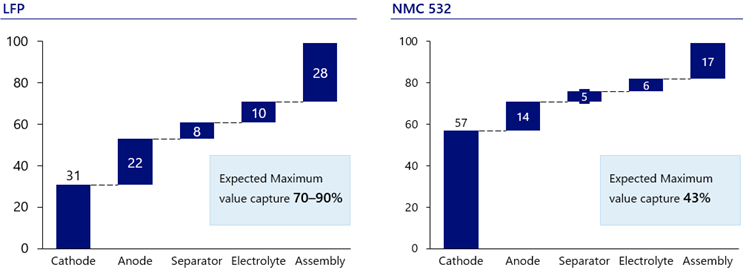

Nevertheless, despite the formidable challenges concerning the procurement of raw materials for cathode and anode production, India remains poised to unlock a substantial portion of the battery’s value chain. The potential includes harnessing more than 90% of the packing component’s value, achieving between 70% to 90% of the LFP cell’s value, and realizing up to 43% of the NMC cell’s value. To embark on this journey, India must prioritize the development of domestic cell manufacturing capacity.

Raw materials

Raw materials are the lifeblood of lithium-ion battery (LiB) localization. Securing a stable and domestic supply of essential elements such as lithium, cobalt, nickel, graphite, and other critical components is paramount to reducing dependence on imports and achieving self-sufficiency in LiB production. Developing a robust supply chain for these raw materials is not only economically strategic but also vital for the long-term sustainability and competitiveness of the electric vehicle industry in a rapidly evolving global landscape.

Cathode materials scenario

Source: IEA, Niti Aayog, NRI Analysis

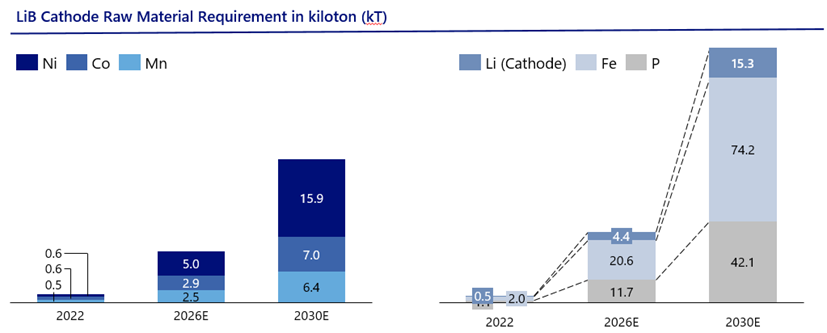

Demand for critical elements is expected to exhibit moderate growth by 2030, with LFP chemistry taking centre stage and advanced NMC variants gaining traction. Nickel and cobalt demand is projected to increase, but at a slower pace, due to the shift towards advanced NMC (811)formulations that utilize less nickel. Iron and phosphorus will emerge as pivotal raw materials, with an estimated demand of 74 kilotons and 42 kilotons, respectively. These insights underscore India’s strategic trajectory in LiB battery manufacturing, with a focus on optimizing raw material usage, fostering sustainable chemistry choices, and aligning with the nation’s commitment to eco-friendly mobility solutions.

Anode materials scenario

Source: IEA, Niti Aayog, NRI Analysis

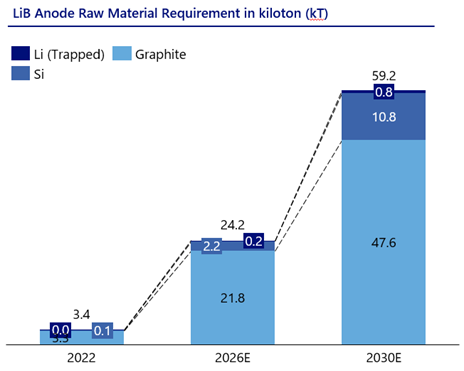

Graphite, the cornerstone of anodes for LiB cells, is expected to witness a steady rise in demand, but silicon-doped graphite is poised to be a game-changer, reducing the demand per kWh of energy produced. Anodes in LiB cells are primarily graphite-based, but silicon-doped graphite is gaining traction and is projected to increase its share from the current 30%. This transition is significant as Si-Gr anodes consume less graphite while offering improved efficiency.

As new technologies like solid-state batteries emerge, they are set to increase the lithium content in anodes. Conversely, sodium-based chemistries will usher in reductions in lithium content.

Major players operating in the Indian battery space

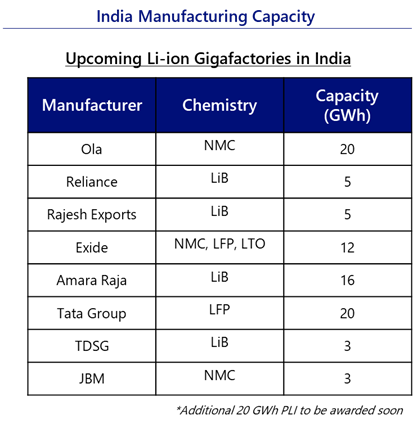

India’s LiB manufacturing industry is booming, with several key players investing in new facilities to support the growing electric vehicle(EV) market.

Ola Electric, Reliance, and Rajesh Export have been selected under the PLI scheme to receive incentives for cell manufacturing and are expected to

start production by 2024.

Traditional battery manufacturers such as Tata AutoComp Systems, Exide Industries, and Amara Raja Batteries are also expanding their LiB presence. MSIL has invested in the LiB battery plant. Suzuki also plans to utilize India as a Lithium-ion battery manufacturing base to meet domestic and export demand.

Image by Nomura Research Institute

These companies are also partnering with research institutes to develop new LiB technologies. For example, Exide Industries has signed an MoU with IIT Chennai, and Amara Raja Batteries has partnered with the Andhra Pradesh Economic Development Board.

Cell components – key activities in India

There is a critical need to localise the cell supply chain. The cell materials constitute around 40% of its cost, and India has minimal availability of cell raw materials. If India targets to achieve 60% of the value addition (as mandated by the PLI), it needs to localise the manufacturing of anode, cathode, electrolyte, and separator.

Anode

The landscape of anode manufacturing in India is evolving with a dual focus on securing global demand and preparing for future domestic needs. Anode manufacturers in India are actively seeking approval from global battery manufacturers, as this collaboration ensures a steady demand for domestically produced anode materials. Export-oriented strategies are being adopted, as it is anticipated that domestic demand from local cell manufacturing companies will take more than three years to materialize.

Indian-made anodes are poised to be competitively priced, making them attractive to battery manufacturers seeking supply chain diversification, aligning with the “China+1” approach. Key players like Epsilon Carbon, HEG, and Himadri are investing substantially to expand their production capacities, with targets ranging from 20,000 to 100,000 MT by 2030.

Cathode

Cathode manufacturing in India is poised for growth, with companies preparing to enter the sector as demand matures and long-term supply contracts materialize. However, several challenges need to be addressed. The lack of clarity on battery chemistry poses a significant hurdle, as cathode production is closely tied to cell chemistry, making it challenging for manufacturers to estimate demand accurately. Additionally,

the absence of government incentives or schemes specifically targeting cathode manufacturing, coupled with the substantial investment required, presents a barrier to entry. Moreover, the limited technical expertise within Indian companies necessitates technology transfer agreements with overseas players to bridge the knowledge gap, while securing a stable supply of raw materials remains a pressing challenge.

In this evolving landscape, key companies are making strides. Altmin, in collaboration with ARCI, is set to establish a pilot plant for cathode materials in Hyderabad, Telangana. The company has partnered with the Telangana government to initiate C-LFP active battery material production.

Electrolyte

Electrolyte manufacturing in India for Lithium-Ion Battery (LiB) cells is currently in its nascent stages, but it has been attracting increasing interest from both domestic and international companies. One notable aspect favouring electrolyte production in India is the local availability of salt, a key component in electrolyte formulation. However, despite the accessibility of salt, procuring it locally may present challenges due to stiff competition within the domestic market.

On the flip side, the manufacturing of battery-grade solvents such as Ethylene Carbonate (EC), Ethyl Methyl Carbonate (EMC), and Dimethyl Carbonate (DMC) remains a hurdle, as these solvents are not produced locally in India and must be imported. Currently, only commercial-grade solvents are readily available within the country.

Similarly, the production of additives, another crucial component of electrolytes, faces the same challenge of limited local manufacturing capabilities, necessitating their importation. As the LiB industry in India continues to evolve, addressing these challenges and establishing a robust supply chain for electrolyte production will be pivotal in supporting the growth of the electric vehicle and energy storage sectors.

Image by Nomura Research Institute

Separator

The separator manufacturing landscape in India has attracted investments from global manufacturers, but there are several key considerations at play. To ensure demand security, long-term contracts with established non-startup companies are crucial. This is because the domestic market is still relatively underdeveloped. Raw material supply remains another critical factor, and companies are actively scrutinizing potential suppliers to establish a reliable local supply chain.

Separator manufacturing is agnostic of cell chemistry but varies depending on the battery application. For instance, separators used in Energy Storage Systems (ESS) applications do not require coating. Another key consideration lies in the choice between wet and dry process separators. Wet process separators cater to the surging demand for Electric Vehicle (EV) batteries, while dry process separators are well-suited for the growing demand in ESS, driven by increasing Renewable Energy (RE) penetration.

Some key players in the emerging Indian separator manufacturing landscape include Neogen, Daramic, and ENTEK.

- Neogen plans to establish a manufacturing capacity ranging from 1200 – 2400 tons a year.

- Daramic, an Asahi Kasei Group company, currently manufactures Polyethylene (PE) separators in India for Lead Acid Batteries and is prepared to transition to Li-ion battery separators in the future.

- ENTEK, a global player, is exploring establishing a manufacturing plant for Absorbent Glass Mat (AGM) battery separators in India.

The rising prominence of separator manufacturing in India’s burgeoning energy storage and electric vehicle industries is underscored by these investments from leading players.

Way forward for India – Recommendation

In a concerted effort to bolster LiB localization and fortify the supply chain, several key recommendations have emerged as catalysts for India’s electric vehicle industry growth.

- Firstly, the effectiveness of the Production-Linked Incentive (PLI) scheme for Advanced Chemistry Cell (ACC) production cannot be underestimated. While it undoubtedly promotes battery manufacturing capabilities in India, expanding its scope to include smaller players is essential. Beyond this, a more holistic approach is warranted.

The scheme should encompass not only cell manufacturing but also extend support to upstream suppliers, such as Cathode Active Material (CAM) and pre-CAM producers, and downstream participants, including battery recyclers. Furthermore, introducing a fresh PLI scheme that incentivizes the entire value chain for raw material supply would be a strategic move.

- Secondly, India’s EV supply chain potential holds significant promise, especially when combined with export ambitions. To amplify this potential, it’s imperative to integrate small businesses into the PLI for materials and foster an ecosystem that nurtures their growth. The goal should be to expand exports of EV vehicles and components, targeting burgeoning markets in Southeast Asia, LATAM, and MENA regions. To achieve this, substantial investments in research and development, coupled with supply chain enhancements, are crucial for ensuring the competitiveness of Indian products on the global stage.

- Lastly, a series of additional policy interventions are recommended. India should expedite the release of a battery-swapping policy to expedite infrastructure development and provide GST benefits for swapping and charging service providers. Furthermore, fostering the processing industry is pivotal, as it encourages investments upstream in critical minerals. These strategic moves collectively pave the way for India’s ascent in the global EV industry and strengthen the foundation for sustainable growth.

This article was first published in EVreporter Oct 2023 magazine.

Subscribe & Stay Informed

Subscribe today for free and stay on top of latest developments in EV domain.